The news of Ukraine tension has once again ignited investors’ pursuit of safe-haven assets. On Friday, Ukraine stated that their forces were attacked by shelling from Russian territory. Ukrainian artillery has also tracked a Russian armoured column destroying a significant part of it.

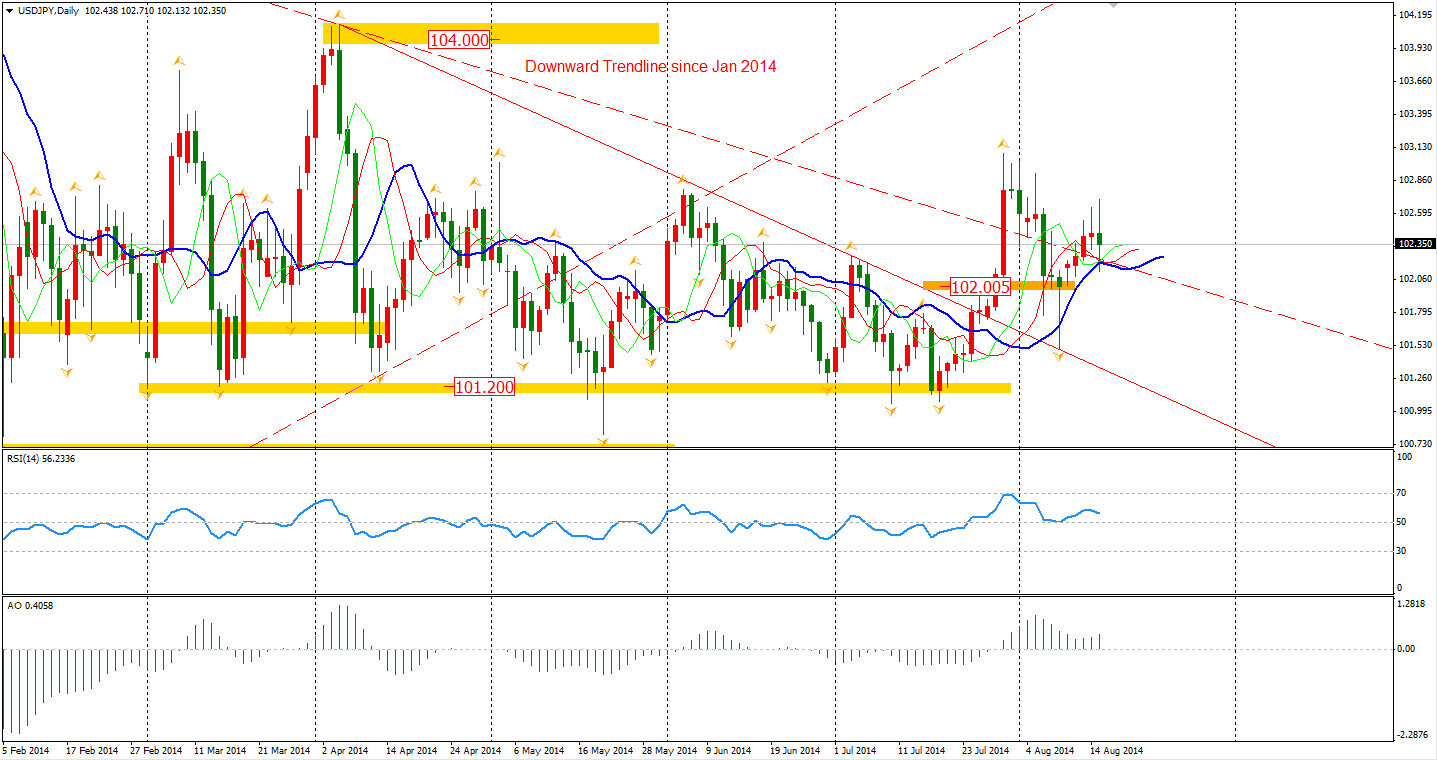

Against this news, the US Dollar slid 0.4% to as low as 102.13 from 102.63 as the yen strengthened. Now, we are seeing more worrisome signals if this tension does indeed escalate. We should in the least review the outlook of a weaker Yen. The potential of rising USDJPY is limited – unless the situation in the Ukraine subsides.

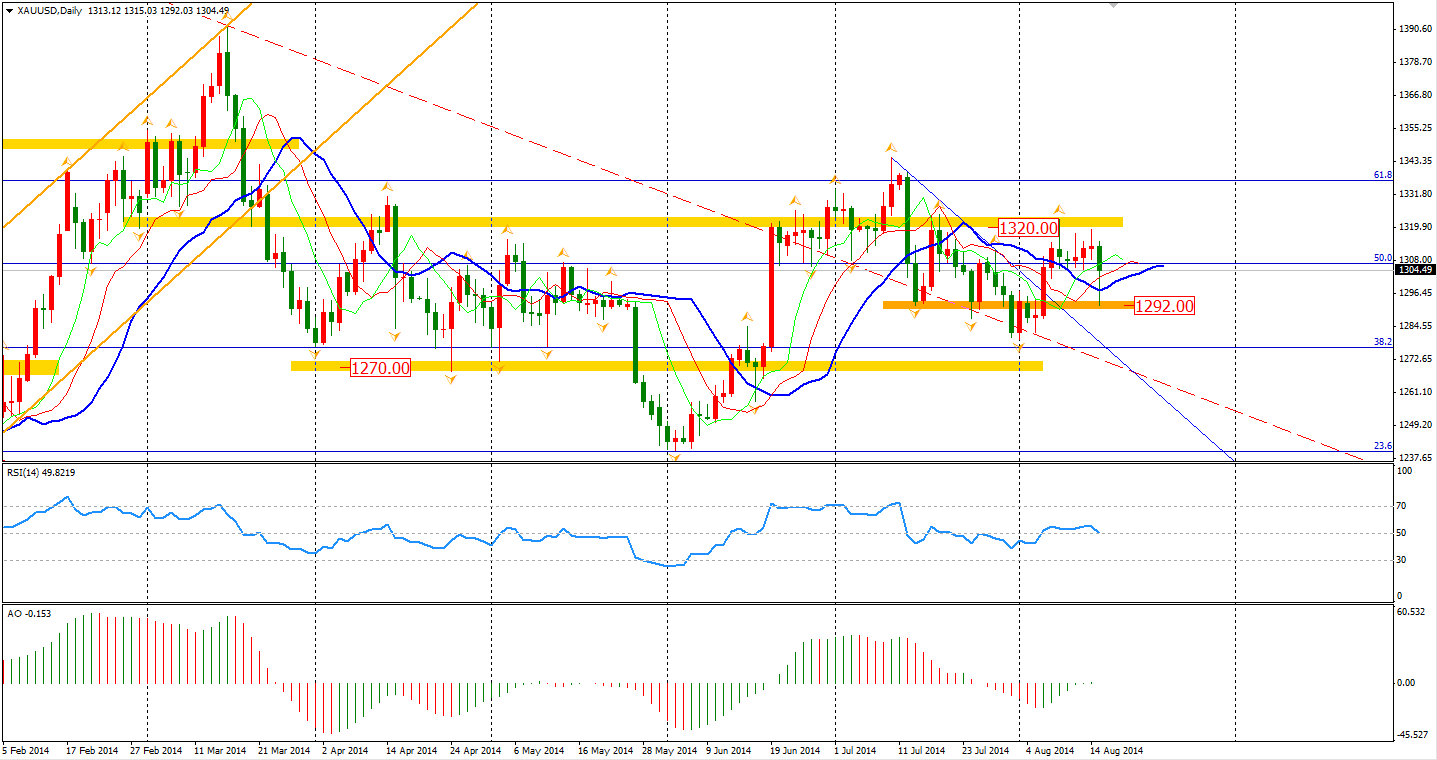

What a rollercoaster day it has been for Gold. Its prices plummeted over $20 from a day high of $1315 per ounce to $1292 within only two hours. However, the prices strongly bounced back from that low to $1310 following reports of renewed hostilities in the Eastern Ukraine. It is hard to tell which way Gold is heading as warfare is almost impossible to forecast. However, the fact that the $1320 resistance has not been broken is a permissible sign. The speculation of a healthier U.S. economy and an early rate rising from Fed limits the Gold appreciation. Also, traders should watch the support level of $1292 breaking, of which could be a sign for selling.

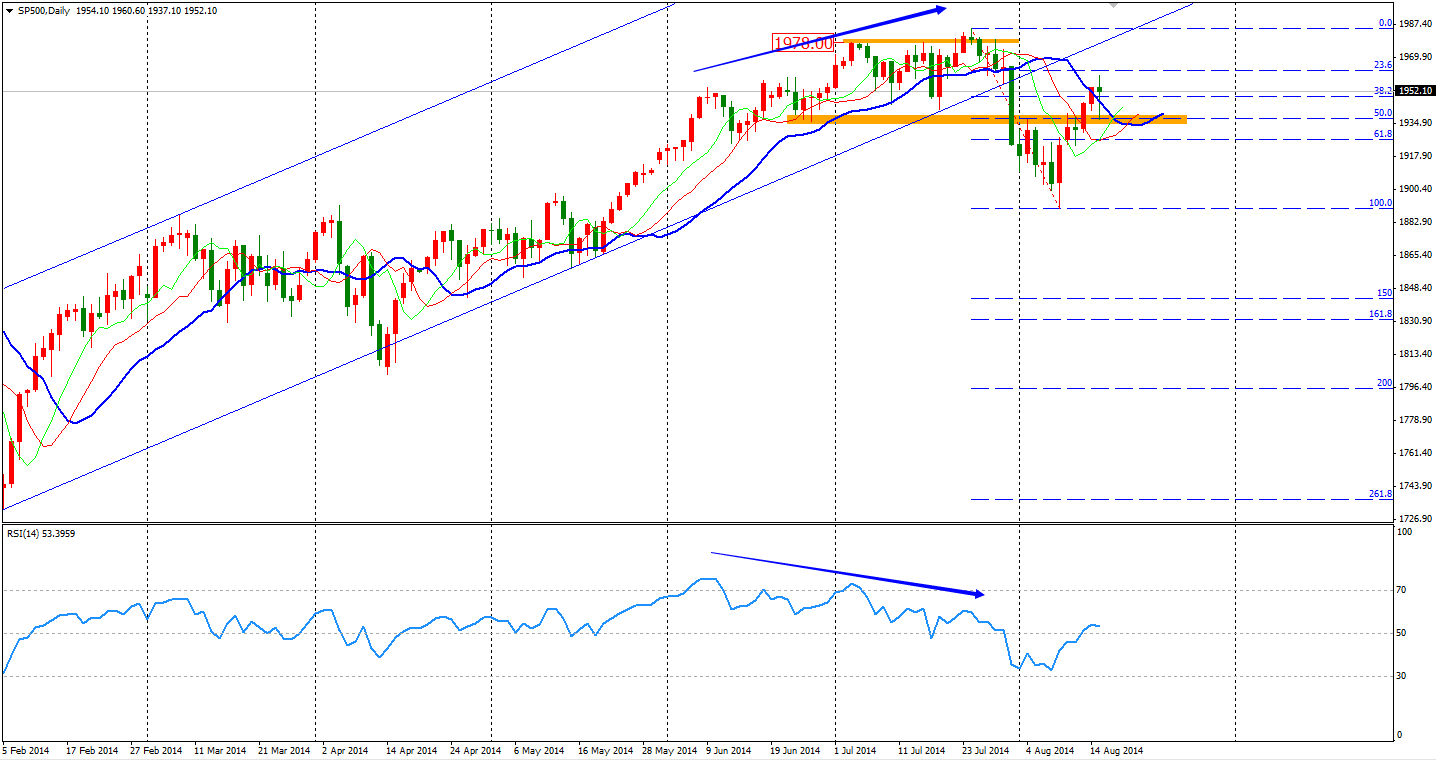

The Asian stock markets edged higher on Friday, led by Chinese market. The Shanghai Composite surged 0.92% to 2226. The Nikkei Stock Average closed flat. The Australian ASX 200 retreated 0.33% to 5566. The European stock markets were mixed. The FTSE gained 0.06%, the German DAX gained 0.73%, and the French CAC Index fell 0.74%. U.S. stocks opened in a positive territory but lost most gains on the fresh conflict. The Dows closed fell 0.3% to 16662. The S&P 500 closed as unchanged at 1955, and the Nasdaq Composite Index was up 0.27% to 4465.

A side of news worth noting was that Solos is betting on a market collapse and the bet has been doubled to 2.2 billion. Shall we be alarmed for the fall of S&P500?

On the data front today, we only have the Australia New Motor Vehicle Sales which will be out at 11:30am AEST, but we will see the Monetary Policy Meeting Minutes for RBA, BOE and Fed later this week, along with PMI data of China, Japan and Eurozone.

Recommended Content

Editors’ Picks

AUD/USD recovers to near 0.6450, shrugs off mixed Australian jobs data

AUD/USD is rebounding to near 0.6450 amid renewed US Dollar weakness in the Asian session on Thursday. The pair reverses mixed Australian employment data-led minor losses, as risk sentiment recovers.

USD/JPY bounces back toward 154.50 amid risk-recovery

USD/JPY bounces back toward 154.50 in Asian trading on Thursday, having tested 154.00 on the latest US Dollar pullback and Japan's FX intervention risks. A recovery in risk appetite is aiding the rebound in the pair.

Gold rebounds on market caution, aims to reach $2,400

Gold price recovers its recent losses, trading around $2,370 per troy ounce during the Asian session on Thursday. The safe-haven yellow metal gains ground as traders exercise caution amidst heightened geopolitical tensions in the Middle East.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.