Again, geopolitical tensions became the focus of the market. Russia has declared intentions of sending humanitarian convoy to eastern Ukraine, which is suspected by Western nations as a pretext for invasion, mirroring the way Russian troops entered Georgia in 2008. Kiev is refusing any trucks entering the border unless monitored by Ukrainian government. Relief came with the news that Russia and Ukraine has reached an agreement whereby the Red Cross will be passing over the humanitarian supplied once meeting the convoy at the border.

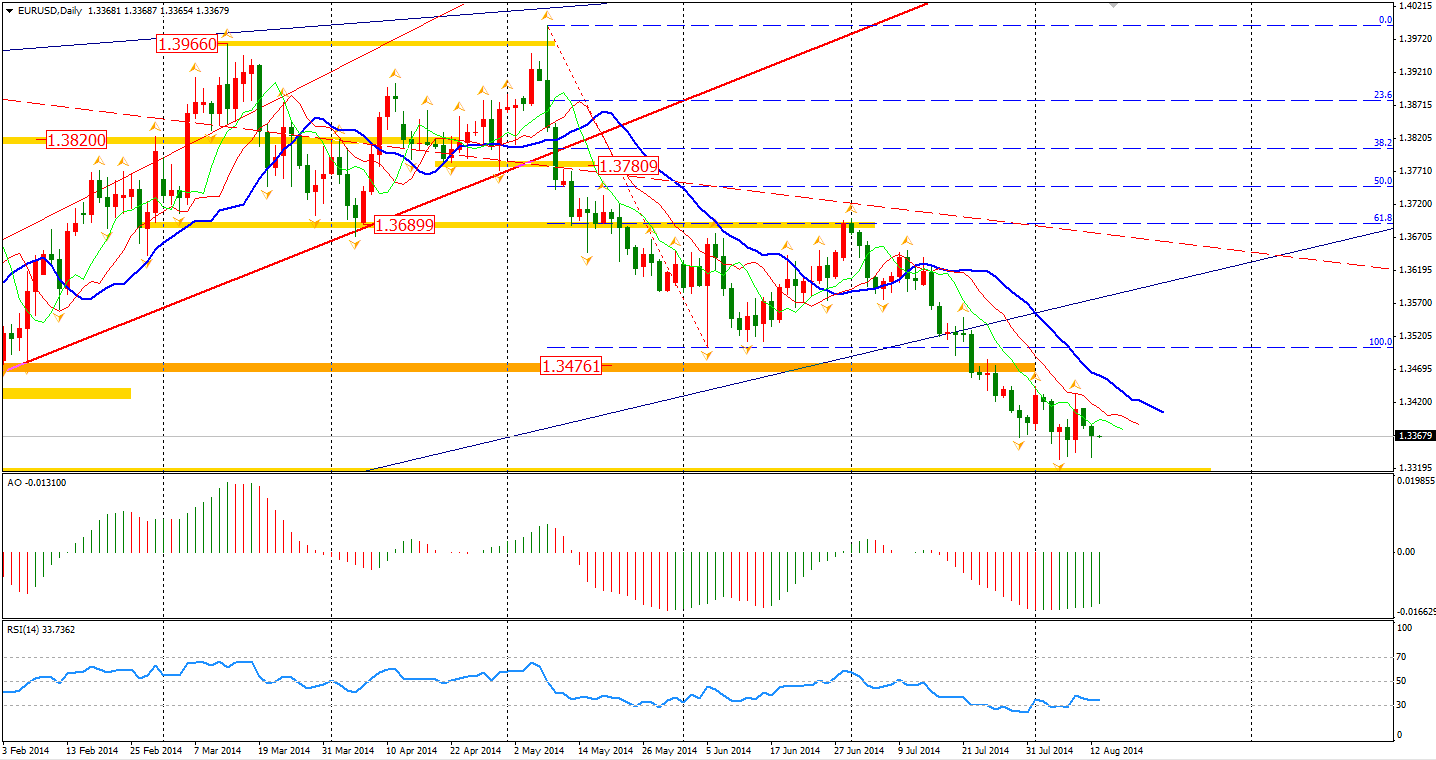

The escalating tension has pared the Euro near to its 9-month low 1.3335 on Tuesday. German ZEW Economic Sentiment fell to 8.6, the lowest level since December 2012, and well below the expected 18.2. German companies’ willingness to invest appears to be hurt by the tensions between EU and Russia.

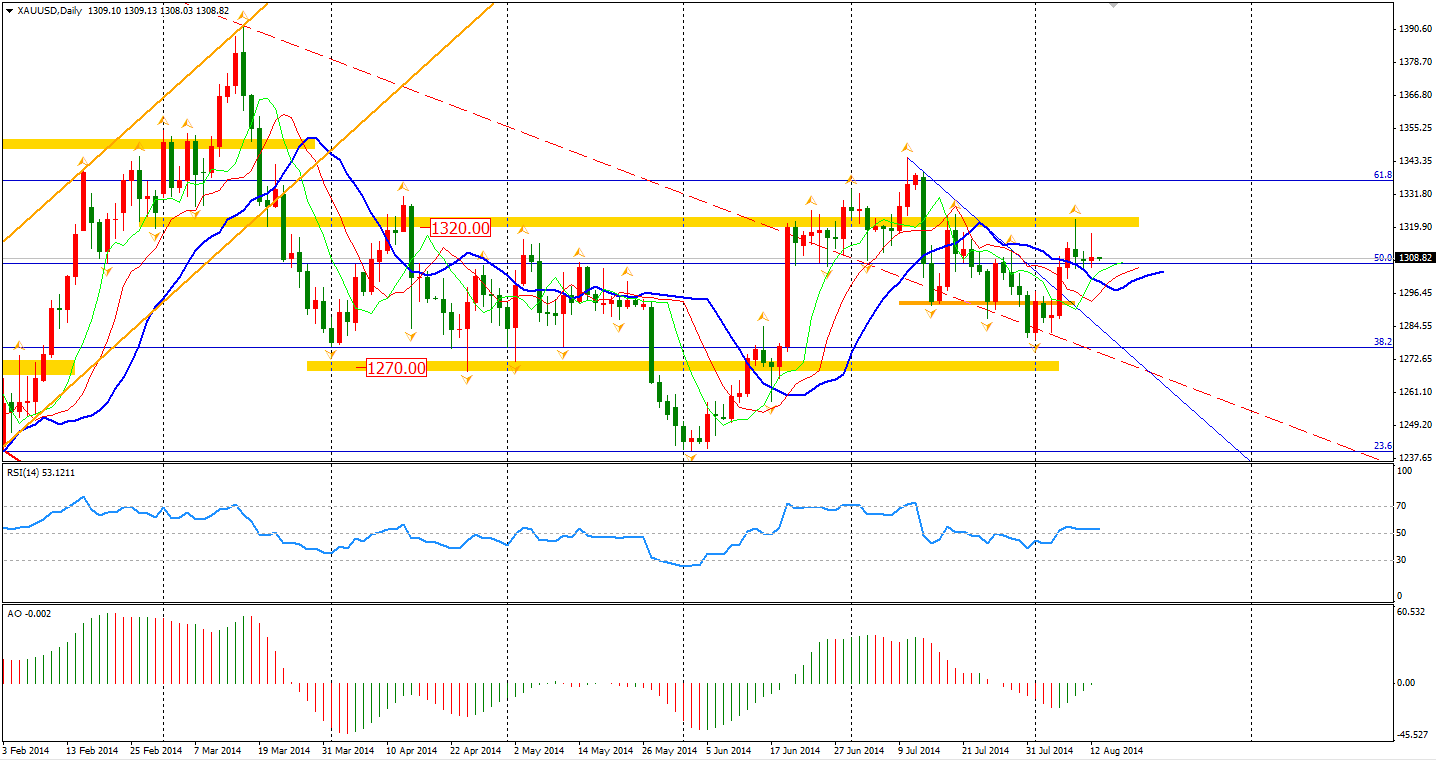

Meanwhile, Israel and Hamas has failed to make any progress on a truce in Gaza. The news touched the nerve with the market. Gold surged to $1317 per ounce from the day low at $1305, but it then erased all gains in the second half of U.S. session. If the insurgencies worsen in Ukraine or Middle East in next few days, the resistance level of $1320 still can be tested.

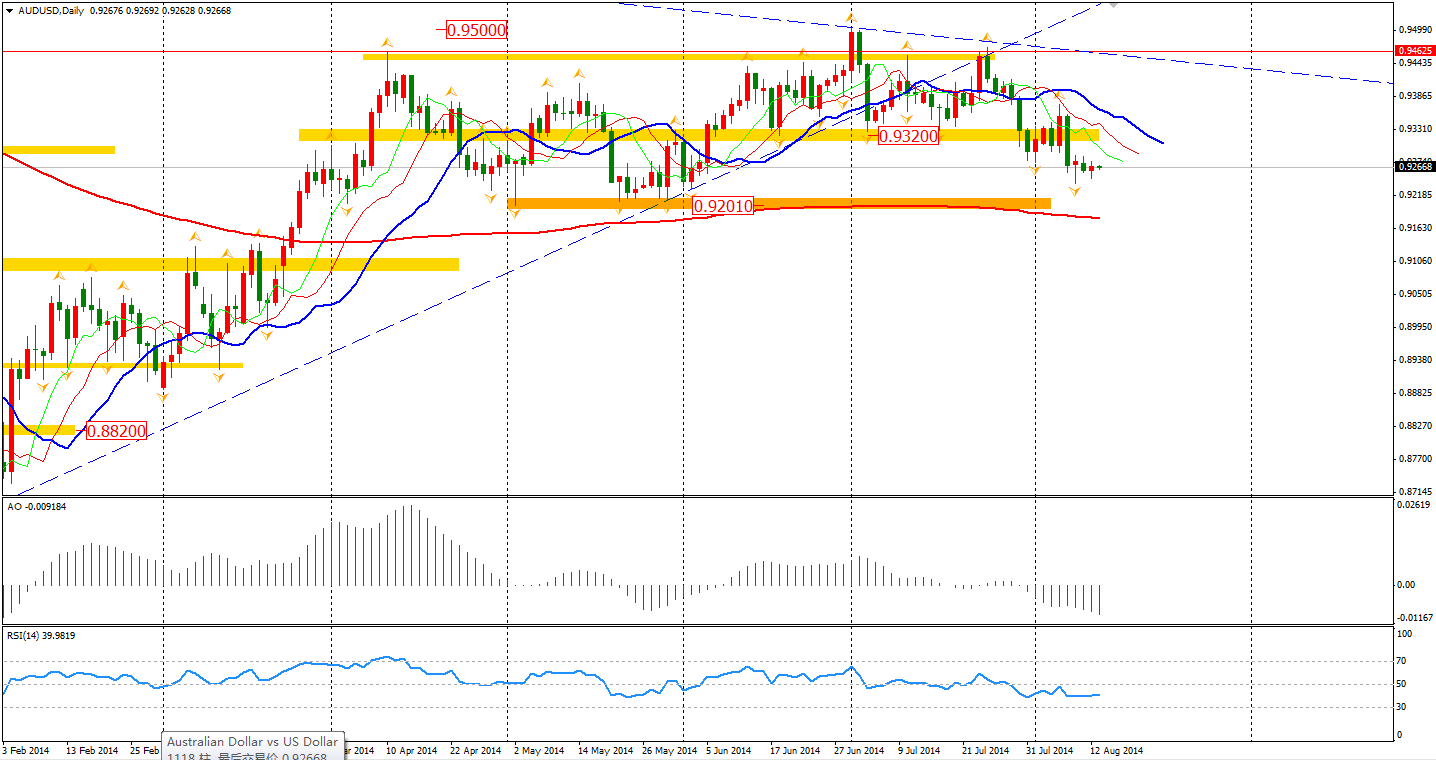

The Aussie gained some support from the upbeat NAB Business Confidence which was 11 against an expected 8. However, the data is hard to maintain at this level and provide little help for the currency. The Aussie Dollar kept its weakness under 0.93 at the expectation of RBA’s rate cut decision increasing amongst the market. According to the CFTC data, the bearish position of the AUD has reached its highest level since January after the unemployment rate surprisingly rose to 6.4%, which was even higher than the U.S. current level. We can maintain a bearish outlook of Aussie Dollar.

The Asian stocks markets had mixed results yesterday. The Nikkei Stock Average rose 0.2% while the Shanghai Composite edged 0.14% lower to 2222. The Australian ASX 200 surged 1.34% to 5530 as Business Confidence reached its 10-month high. In the European stock markets, the FTSE closed flat, the German DAX slumped 1.21%, and the French CAC Index lost 0.85%. U.S. stocks closed slightly lower. The Dows closed flat at 16560. The S&P 500 dropped 0.16% to 1934, while the Nasdaq Composite Index was down 0.27% to 4389.

On the data front, Japan Q2 GDP will be out at 9:50 AEST. Australian Westpac Consumer Sentiment and Wage Price Index will be released shortly after. Also, in the afternoon, China major economic data like Industrial Production will be published. UK’s job market data is at 18:30 and US Retail Sales will be at 22:30 AEST.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.