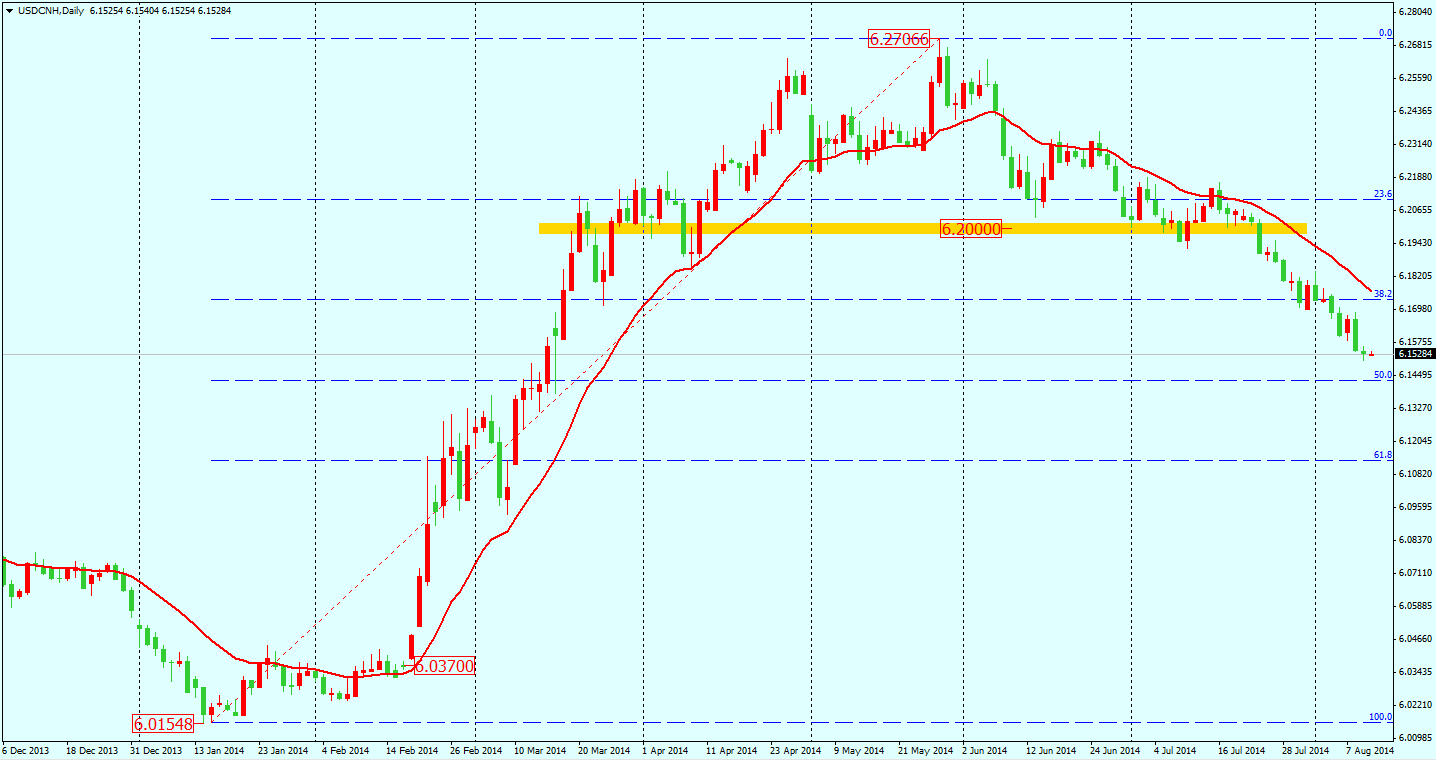

RMB continued its appreciation against the Dollar – reaching a low not seen since mid-March. Last week, China’s trade surplus rose to record levels in July, with exports surprisingly growing 14.5% year on year. The trade data suggests that the recovering international demand may offset the weak domestic consumption helping China achieve its 7.5% annual growth target growth rate. The fall of USDCNH may continue for a while as the China Central Bank has now declared it’ll quit the market operation. We have to remember though, a high growth rate in exports is hard to sustain and the appreciation of RMB may not remain for too long.

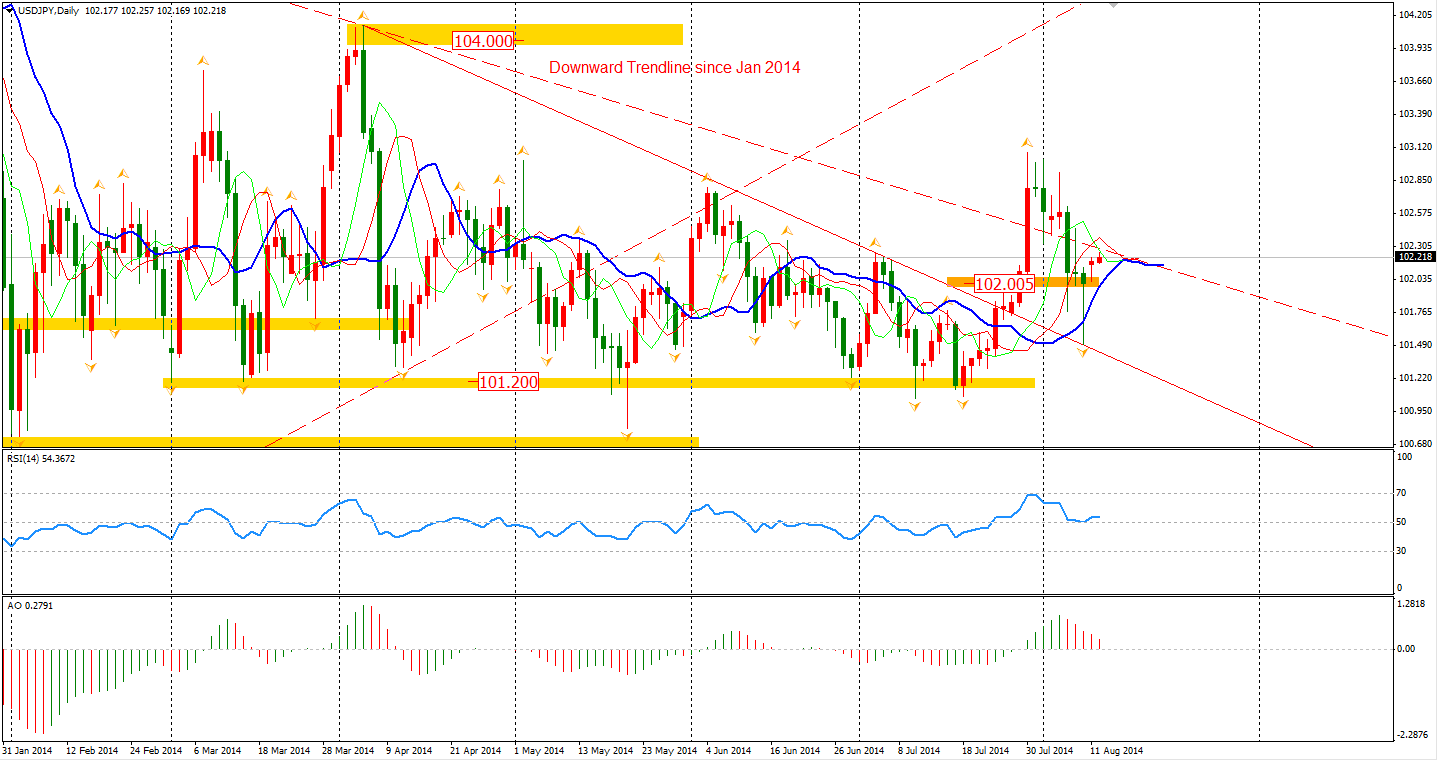

Dollar/Yen bounced slightly from the 102 integer support level, signalling that its fall may cease with the Japan Q2 GDP release is coming soon. The forecast for this GDP growth tomorrow morning is a 6.8% contraction, taking into consideration the significant impact from the recently implemented consumption tax rate raise. Investors are now expecting that the BOJ will have to introduce further monetary stimulus in the near future. These expectations will certainly weaken the Yen. Nevertheless, traders should still bear in mind the risks from geopolitical tensions.

Asian stock markets rebounded on Monday lead by the Japanese market. The Nikkei Stock Average surged 2.38% but has yet to recover from Monday’s loss. The Shanghai Composite bounced 1.38% to 2224. The Australian ASX 200 rose 0.4% to 5457. In European stock markets, the FTSE closed 1% higher, the German DAX rocketed 1.9%, and the French CAC Index surged 1.2%. U.S. stocks closed in a lightly traded session. The Dows gained 0.1% to 16570. The S&P 500 advanced 0.28% to 1937, while the Nasdaq Composite Index was up 0.69% to 4401.

On the data front, Australia NAB Business Confidence will be out at 11:30 AEST. Another data that may attract traders’ interest is the ZEW Economic Sentiment of Germany and Eurozone.

In the rest of this week we will see several data releases for GDP and Inflation from major developed nations. These economic data will provide the market with more clues on each nation’s economic current conditions and potential policies.

Recommended Content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.