The US Dollar jumped up again across the board last night with results showing the U.S. economy growing faster in Q2 than economists had expected. The annual rate of GDP Growth is 4% higher than the forecasted 3% and former reading of 3.1%.

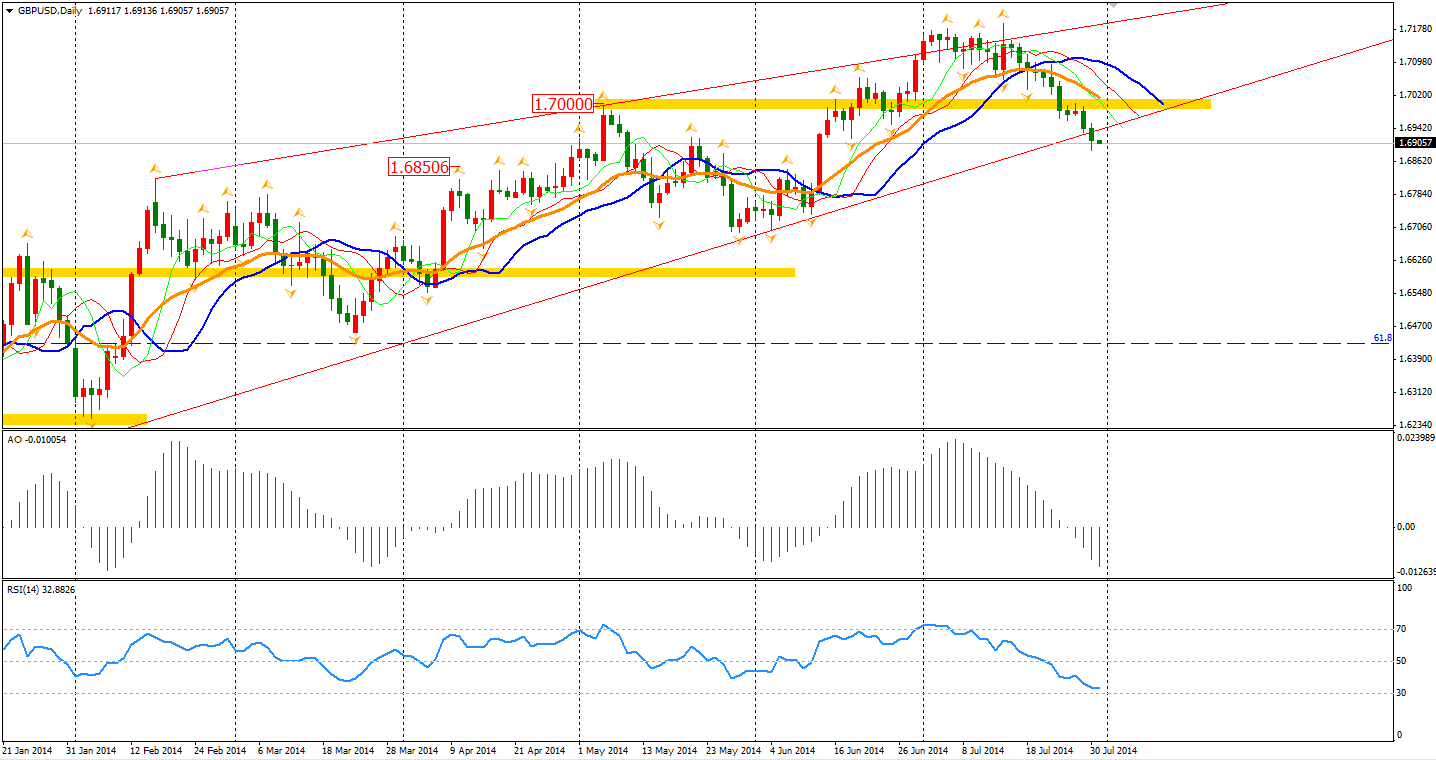

The Sterling kept its weakness yesterday and broke the upward trendline that we had previously mentioned. Although the breakout is not confirmed yet, this certainly is a bad sign for traders who are gone long the sterling against Dollar.

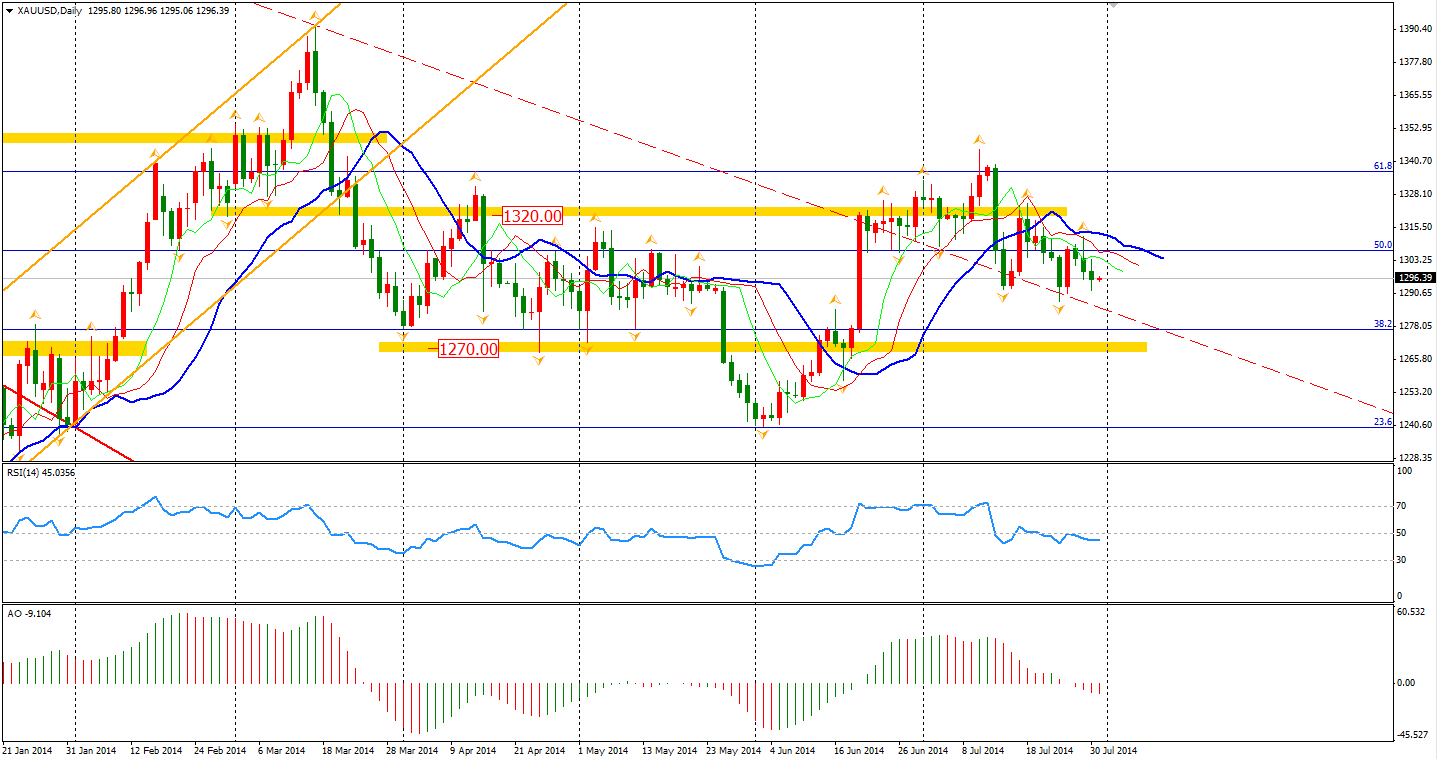

It’s no surprise the Fed continued tapering with another 10 billion dollar monthly bond purchasing amount in its July meeting, but the committee has also boosted its growth perspective on the U.S. economy. The minutes caused little impact on the FX market as the Fed’s policy stays unchanged- is in line with the expectation. Only Gold pared as the positive economic outlook decreased the need of safe-haven assets.

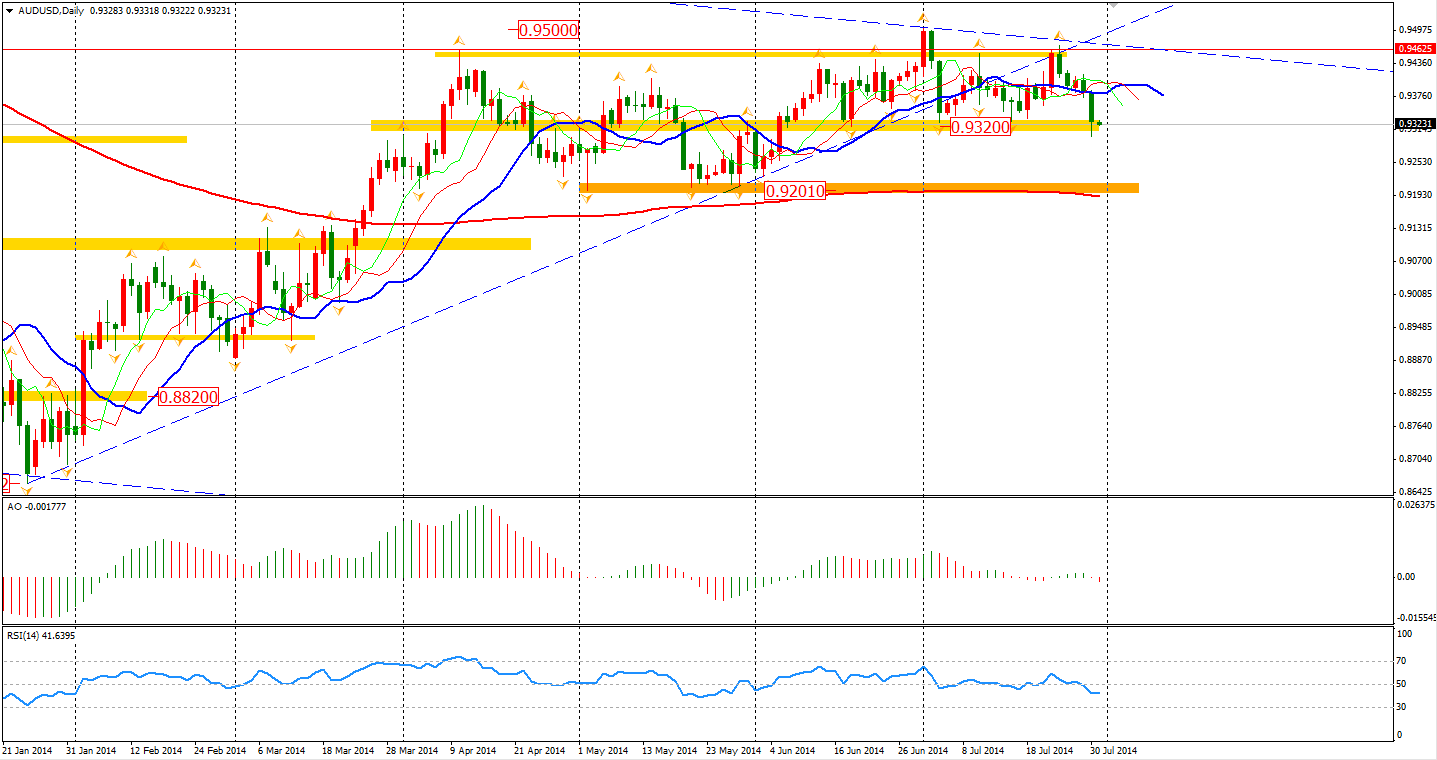

The Aussie Dollar too fell to the support level of 0.9320 yesterday and hit a six-week low. Am I looking at head and shoulder pattern? If the exchange level breaks 0.9320, it will be heading to 0.92.

The Asian stocks moved slightly higher with earnings reports improving. The Shanghai Composite lost 0.1% to 2181 whilst the Nikkei Stock Average gained 0.18%. The Australian ASX 200 advanced 0.62% to 5623. In European stock markets, the FTSE closed 0.5% lower, the DAX lost 0.62%, and the French CAC slumped 1.22%. U.S. stocks were in choppy trading on mixed news of geopolitical tensions, GDP and the Fed’s view on the economy. The Dows lost 0.19% to 16880. The S&P 500 closed flat at 1970, while the Nasdaq Composite Index was up 0.45% to 4463.

In other news, Argentina had failed to reach an agreement with its bondholders and faced a selective default. As has been discussed, this may not mean a domestic crisis for Argentines, but the first domino of a bigger storm. Investors will wait for more information to decide the reaction.

On the data front, local traders will watch the Building Approvals at 11:30 AEST. In the European session, Germany will disclose Retail Sales and Unemployment Change. Also, Eurozone CPI Flash Estimate may have significant impact on Euro if the data is other than the expected 0.5%. Later, at 22:30, there will be Canada GDP and U.S. Unemployment Claims.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.