“It was the best of times, it was the worst of times, it was the age of wisdom; it was the age of foolishness.” I always recall this line of Charles Dickens, especially of late with markets staying flat and not reacting on risk events.

Central banks have paralysed the financial markets. When the U.S. released a new series of sanctions on Russia and the MH17 was shot down, safe-haven assets rose and stocks fell, but the trend only lasted for a day and recovered in no time. Scanning across world, in addition to the Ukraine crisis, Gaza conflicts have escalated, the ISIS has dragged Iraq and Syria into chaos, Argentina is confronting another potential default which may cause a rippling effect in South America, and Southern Europe’s economy is still dire.

And yet, the market is calm.

Is it the best of times when stocks keep rising without drawbacks? Is it the worst of times when markets lose their vitality? Shall we follow the trend and suppose that all those risk events will be under control and have limited impact worldwide? Or is this belief just foolishness?

A sign that may provide us clues is the US Dollar, which has strengthened since last July amid those risks. But will this trend continue?

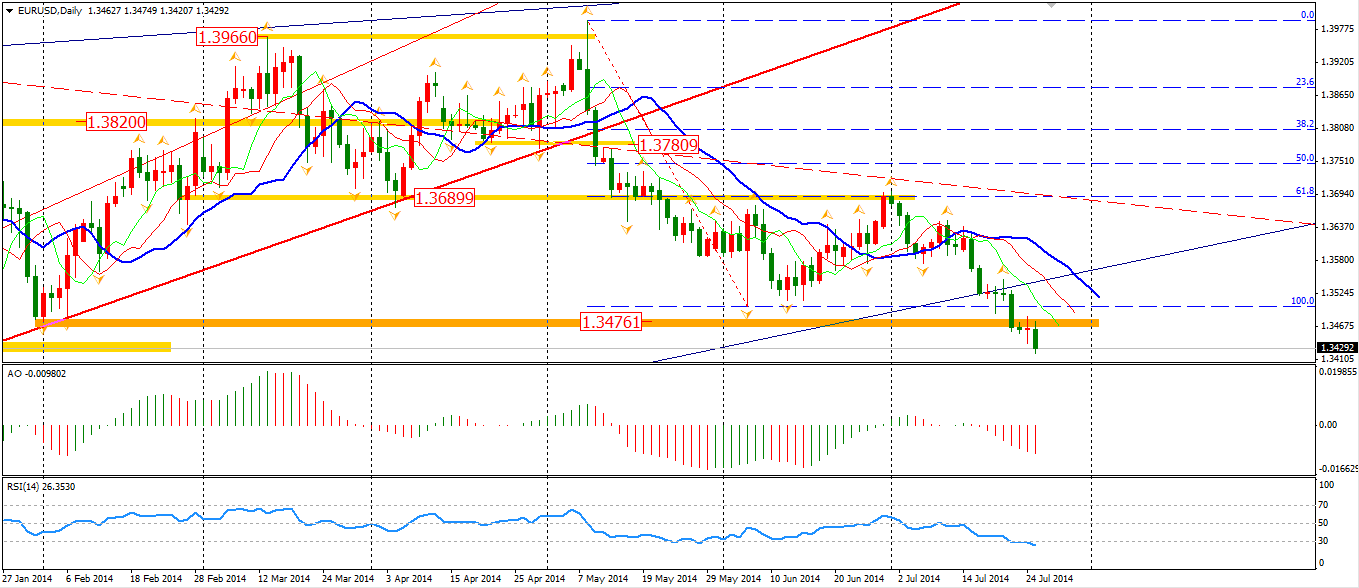

The Euro slid by 0.3% against the greenback to 1.3429, confirming the breakout of a supporting area around the former low of 1.3476. The next support level will be at 1.33 – the low of October 2013.

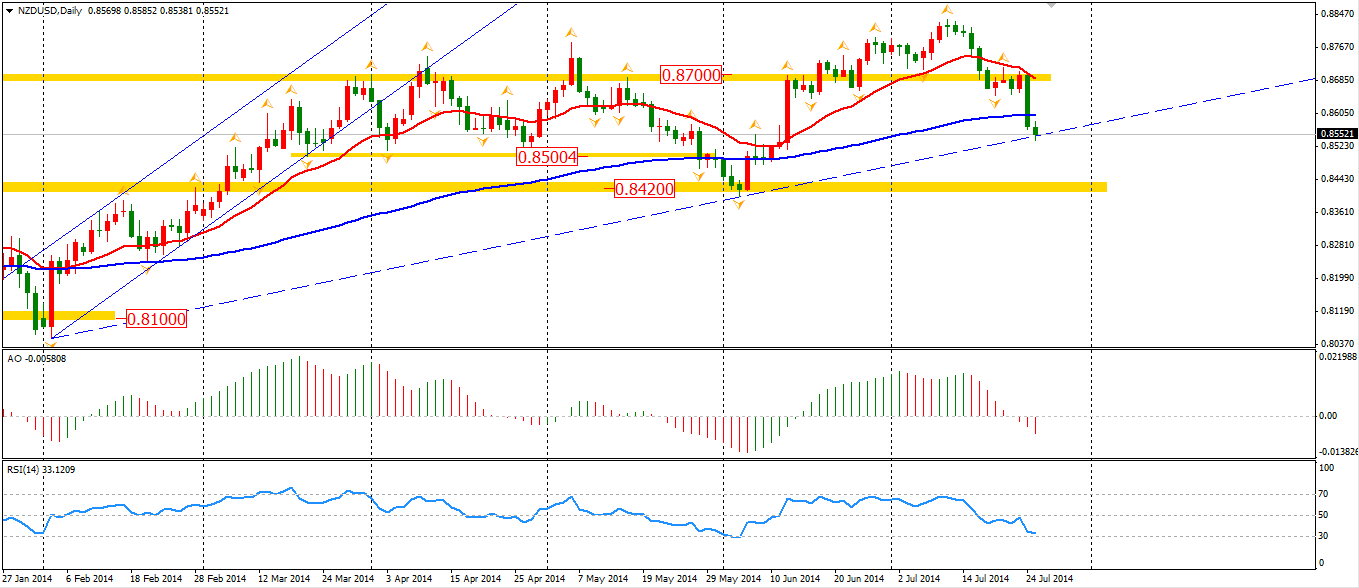

Since the Reserve Bank of New Zealand raised its benchmark rate to 3.50%, the Kiwi dollar has fallen 150 pips to 0.8550, where the uptrend line has been since the beginning of February. We need to watch this support area closely, as it will determine whether the carry trade will continue.

The Asian markets were mixed on Friday, with Japanese stocks inspired by the weaker. The Nikkei Stock Average surged 1.13%. The Australian ASX 200 closed flat at 5584 whilst the Shanghai Composite gained 1.03% to 2127. In the European stock markets, the FTSE closed 0.44% lower, the DAX slumped 1.53%, and the French CAC lost 1.82%. U.S. stocks were in a sea of red as the earnings reports of Visa and Amazon were downbeat. The Dows slid 0.72% to 16961, pulling back below 17000 integer level. The S&P 500 edged 0.48% lower to 1978, while the Nasdaq Composite Index lost 0.5% to 4450.

No important data releases for today – only U.S. Flash Services PMI released at midgnight tonight.

MXT Global Pty Ltd ACN 157 768 566 AFSL 428901. Trading derivatives and forex carries a high level of risk to your capital and should only be traded with money you can afford to lose. Ensure you read our FSG, PDS and Terms & Conditions, and seek independent advice, to fully understand the risks, before deciding to enter into any transactions with MXT Global. The general information on this website is not directed at residents in any country or jurisdiction where such distribution or use would contravene local law or regulation.

Company disclaimer for reports:

#The views and content above are Anthony Wu's own and do not reflect the views of MXT Global.

The research contained in this report should not be construed as a solicitation to trade. All opinions, news, research, analyses, prices or other information is provided as general market commentary and not as investment advice.

MXT Global does not warrant the completeness, accuracy or timeliness of the information supplied, and shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on the service and its content.

No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.#

Recommended Content

Editors’ Picks

AUD/USD favours extra retracements in the short term

AUD/USD kept the negative stance well in place and briefly broke below the key 0.6400 support to clinch a new low for the year on the back of the strong dollar and mixed results from the Chinese docket.

EUR/USD now shifts its attention to 1.0500

The ongoing upward momentum of the Greenback prompted EUR/USD to lose more ground, hitting new lows for 2024 around 1.0600, driven by the significant divergence in monetary policy between the Fed and the ECB.

Gold aiming to re-conquer the $2,400 level

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

Bitcoin price defends $60K as whales hold onto their BTC despite market dip

Bitcoin (BTC) price still has traders and investors at the edge of their seats as it slides further away from its all-time high (ATH) of $73,777. Some call it a shakeout meant to dispel the weak hands, while others see it as a buying opportunity.

Friday's Silver selloff may have actually been great news for silver bulls!

Silver endured a significant selloff last Friday. Was this another step forward in the bull market? This may seem counterintuitive, but GoldMoney founder James Turk thinks it was a positive sign for silver bulls.