The market was significantly impacted by the news of the Malaysia Airline plane that was shot down in East Ukraine last Thursday. The White House tied Pro-Russia separatists with this accident on Friday with Russia responding that the Ukraine government should take the full responsibility. Although, the West and Russia are still arguing who should be blamed for this tragedy, the market has digested the news and the surging price of safe-haven assets like Gold retreated on Friday.

In other news, conflicts continued in Gaza with more civilians being killed, as the Israeli army expanded its ground operation. This event may not largely affect the market now but things will change if the tension in Middle East escalates.

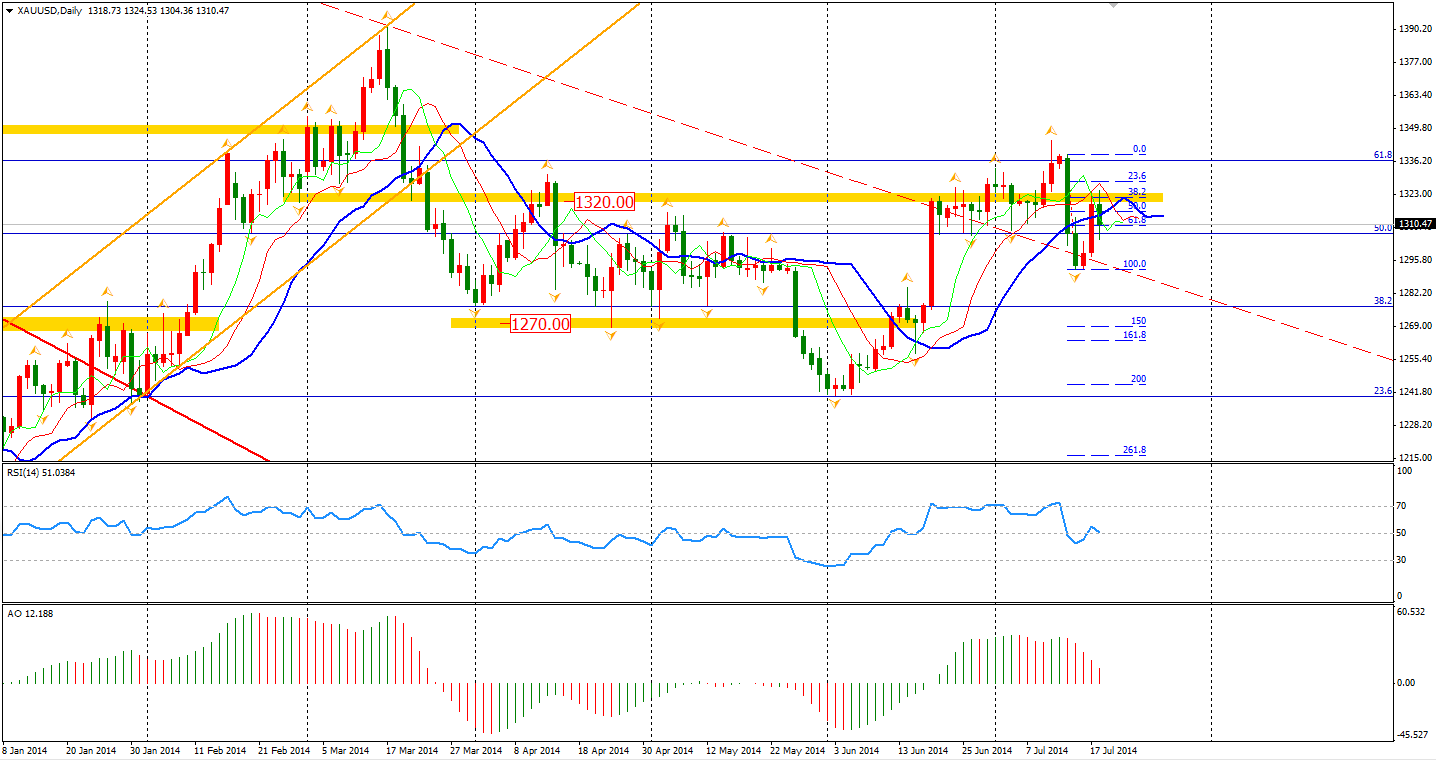

Gold prices fell from the $1320 resistance level on Friday. This level is also the 38.2% retracement level of the slump in the first two trading days of last week. Gold prices are still under pressure in mid-term, as the Fed will probably quit their QE program this October with more affirming signs of a U.S. economic recovery. Those items will most likely strengthen the Dollar over the next few months.

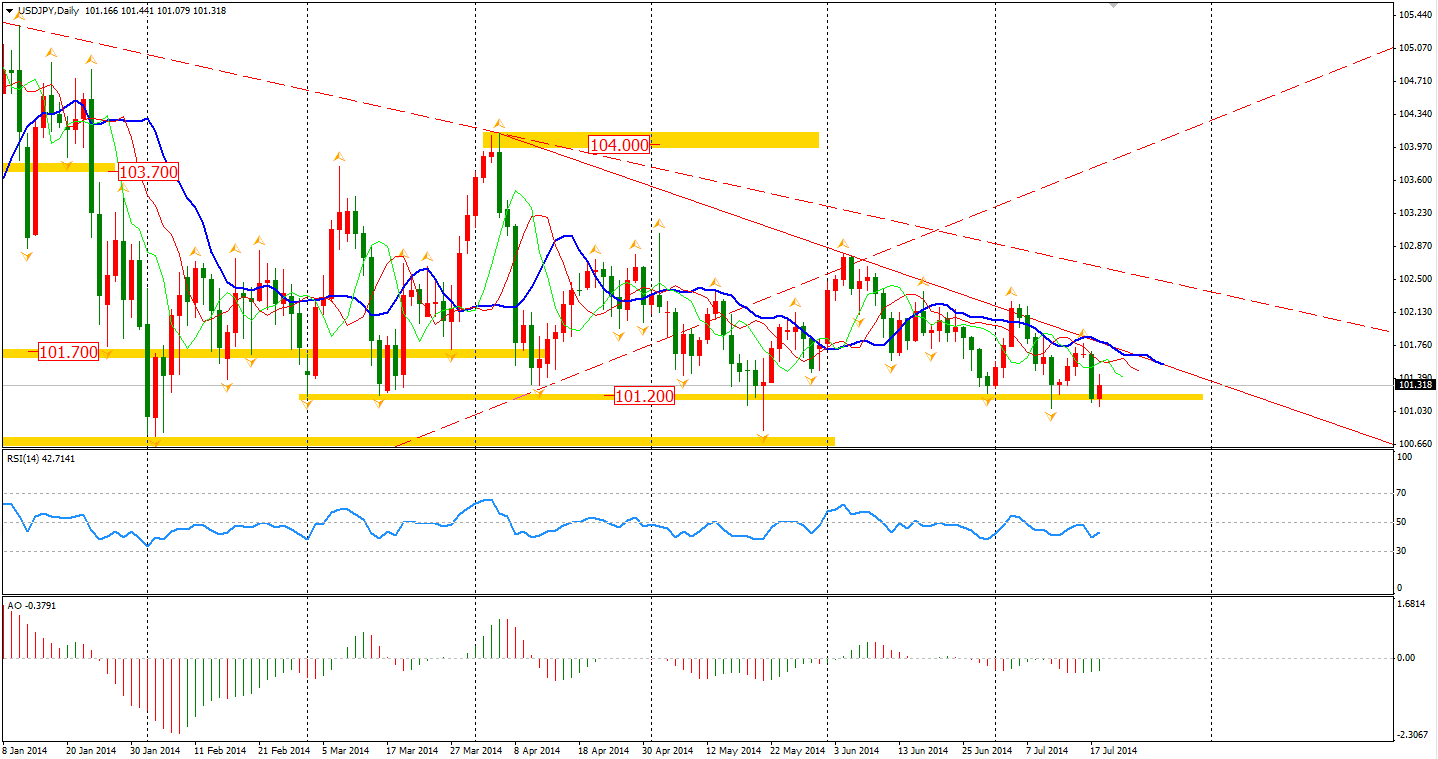

Similarly, Dollar Yen rebounded again from support levels near 101.20. The triangle consolidation is near the breakout.

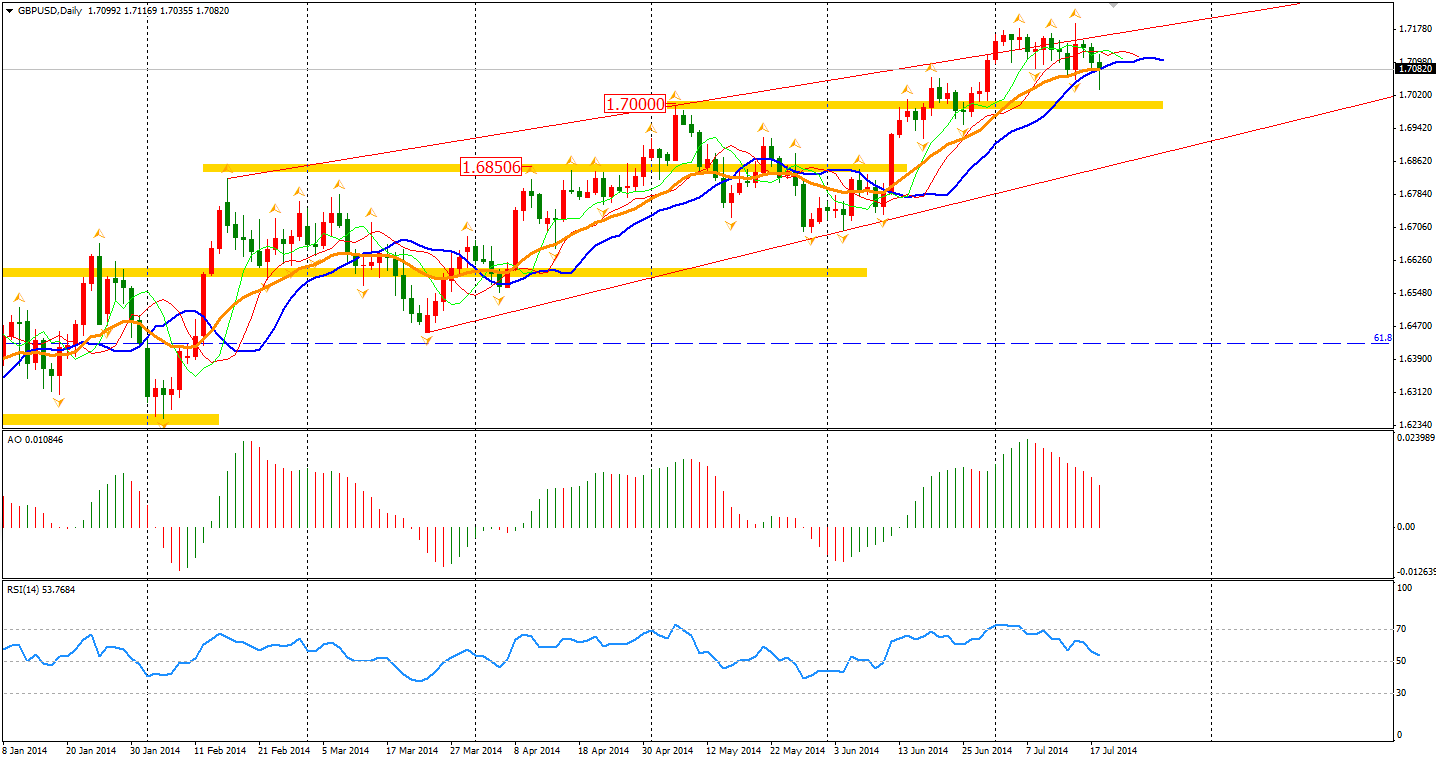

The Sterling fell to 1.7035 against the Dollar during the European trading session, but rebounded shortly from this level finally closing at 1.7082 – just above the 20-day MA.

Most Asian markets performed weakly on Friday. The Nikkei Stock Average suffered from a stronger Yen, losing 1.01%. The Shanghai Composite closed 0.17% higher to 2059. The Australian ASX 200 rose 0.17% at 5532. In European stock markets, the FTSE closed 0.17% higher, the DAX lost 0.35%, and the CAC was up 0.44%. U.S. stocks closed higher on Friday as the fear of geopolitics woes faded and the Dow Jones Industrial Average and S&P 500 closed on a record high. The Dows gained 0.73% to 17100. The S&P 500 edged 1.03% higher to 1978, while the Nasdaq Composite Index surged 1.57% to 4432.

No big data releases for today, but this week, we will see the BOE’s interest rate decision on Wednesday and New Zealand’s one on Thursday. Also UK’s Q2 GDP will the impact sterling and PMI data from China, Eurozone and U.S. shoud be watched closely.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.