The era of US Dollar has truly come. Maybe this statement is quite late, but it is never too late to trade with the trend.

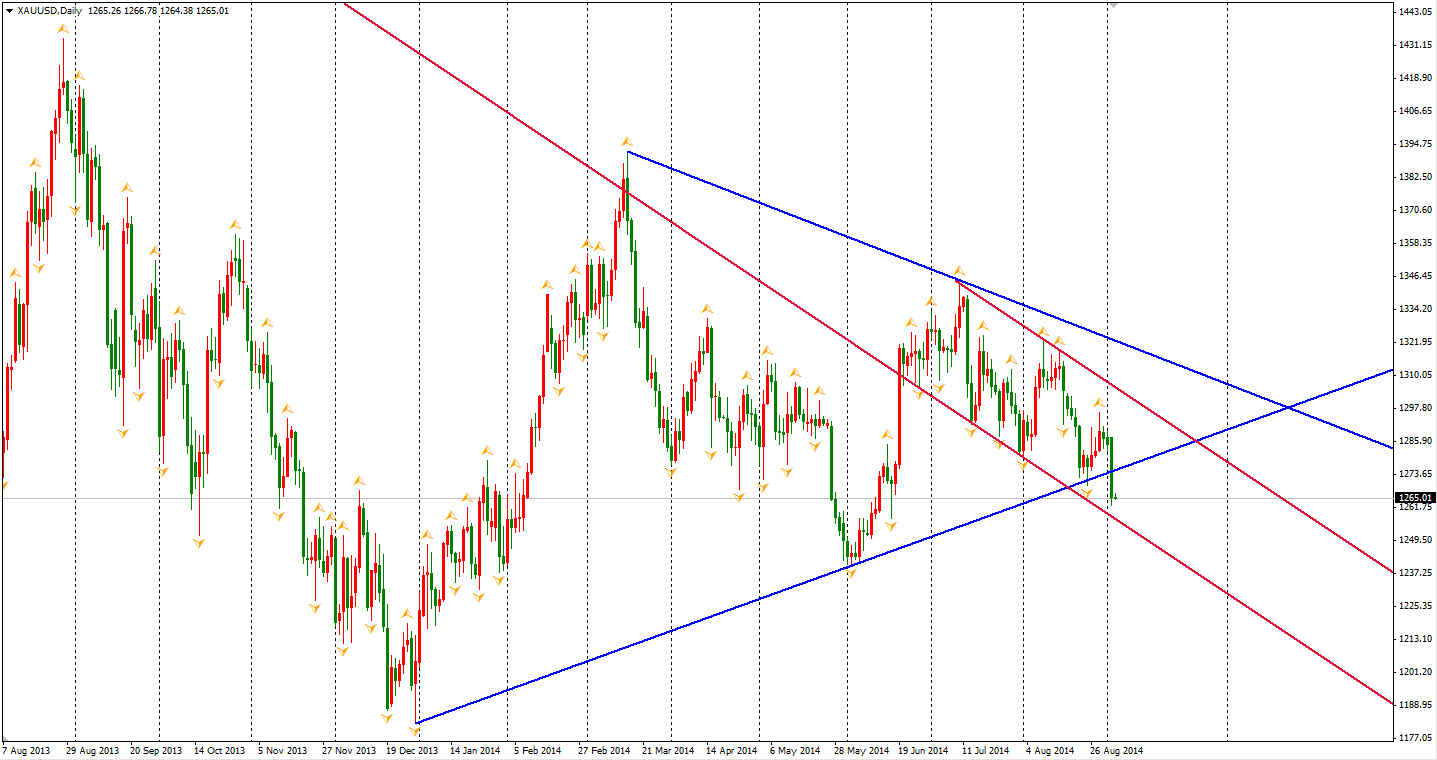

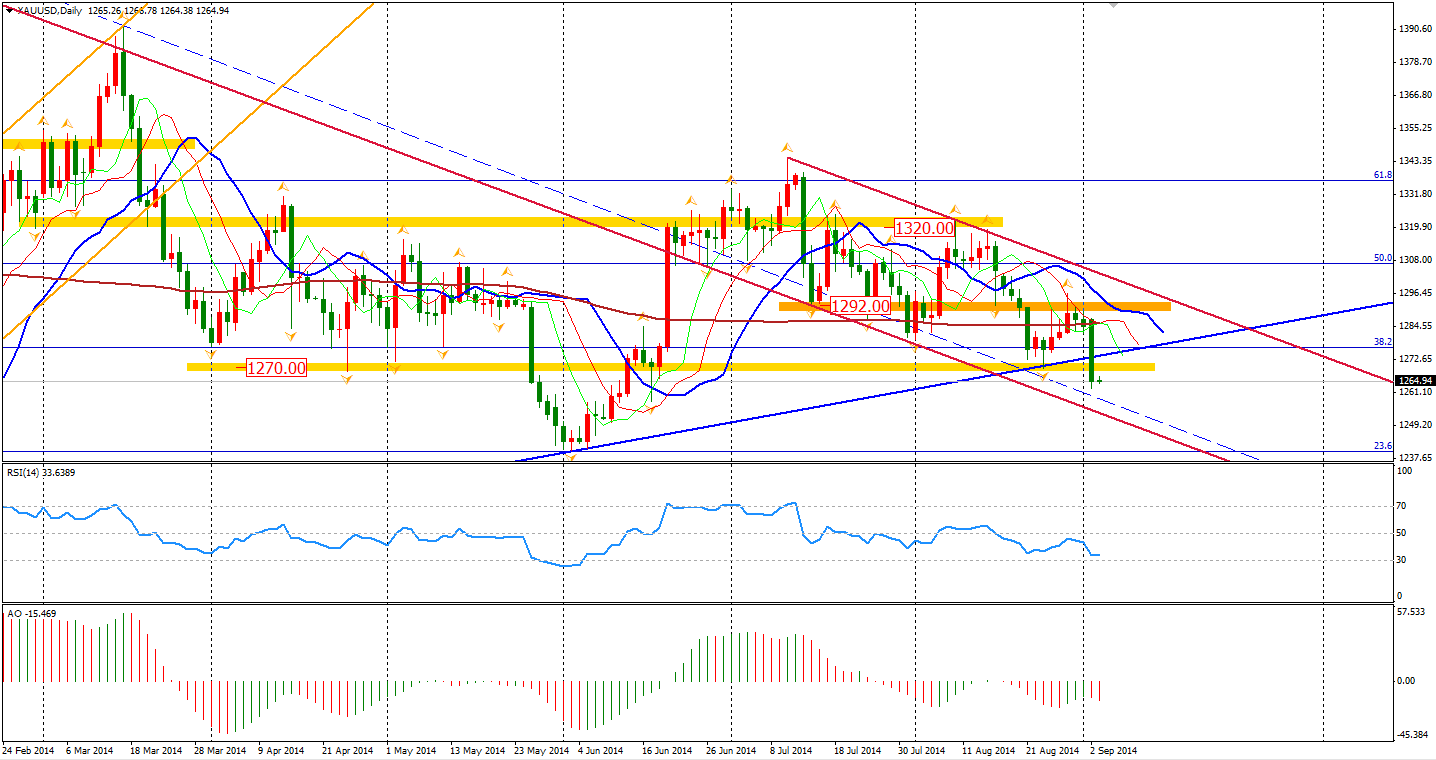

We have witnessed most major currencies depreciating against the Dollar, and now, Gold has joined the party. Gold yesterday plunged by over $23 per ounce to $1265, breaking several key supporting levels, including level $1270 and the uptrend line from the low of last December. The large triangle pattern that Gold has been forming since this year began has now finished and a new bearish trend is under way.

Yesterday’s fall is reminding me of what happened to the Gold price back in April 2013 when it lost over $270 just in one week. Maybe I was too sensitive and that history will never repeat. The break in this triangle continuation pattern still implies Gold may fell below $1180, the double bottom of 2013.

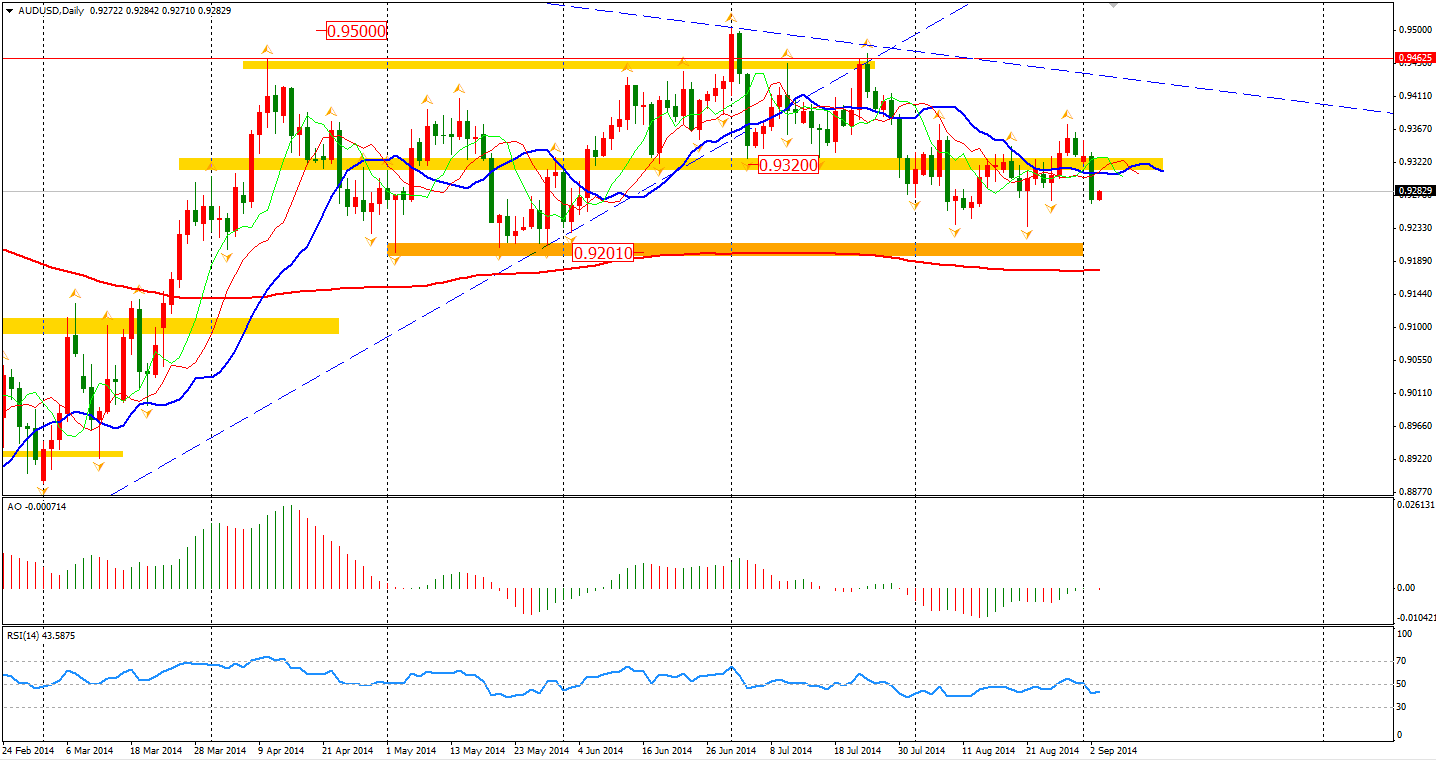

Aussie/Dollar, probably the last one of major currency pairs that defied gravity, fell back below 0.9320 again on Tuesday. Will this time be the one to break the 5-month-length sideway?

The RBA has decided to extend its longest pause in rate adjustments in eight years and its statement did not change much for September, stating that the “exchange rate remains above most estimates of its fundamental value”. Impacted by the background where the Chinese economy is slowing down, Australia’s expansion will be ‘a little below trend’.

The Q2 GDP today and Retail sales tomorrow may decide whether the Aussie will keep falling. The weak job market and contracting company profits have dampened the economic outlook – a clear negative sign of the future price movement.

Asian stocks markets performed quite strongly yesterday. The Shanghai Composite surged up 1.37% to 2266, 15-month high. The Nikkei Stock Average gained 1.24% on the weaker Yen. The Australian ASX 200 was up 0.51% to 5658. In European stock markets, the UK FTSE was up 0.06%, the German DAX gained 0.3% and the French CAC Index lost 0.03%. U.S. stocks closed with little changes after the long weekend. The S&P 500 closed flat at 2002. The Dows lost 0.18% to 17068, while the Nasdaq Composite Index was up 0.39% to 4598.

On the data front, Australia Q2 GDP will be released at 11:30 AEST. The RBA Gov Stevens speech will begin from 13:20 AEST. Several Service PMI will be released during the European session, including the UK one at 18:30 AEST. Canada Central Bank’s decision will be at midnight.

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold price on the defensive, amid soft US Dollar

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum continues hinting at rally following reduced long liquidations

Ethereum has continued showing signs of a potential rally on Tuesday as most coins in the crypto market are also posting gains. This comes amid speculation of a potential decline following FTX ETH sales and normalizing ETH risk reversals.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.