Draghi vows to “do what we must”

ECB President Mario Draghi once again delivered a very dovish message during his speech at Euro Finance Week this morning. His “we will do what we must” comment was almost reminiscent of his “whatever it takes” pledge back in 2012, although of course the latter was far more powerful given the circumstances and no prior warning. The comments today though are still a clear signal to the markets that the ECB intends to provide additional stimulus when it meets in a couple of weeks, the only question now is what will it do and how far will it go?

A cut to the deposit rate looks likely at this stage, as does some form of extension to its quantitative easing program, either through additional purchases, a broader range of instruments or its lifetime. The fact that we’ve seen no reaction to the comments in the equity markets and even some bond yields are higher on the day suggests investors are no wiser on the kind of stimulus the ECB will offer than they were before. However the euro did slide in response to the comments so clearly whatever approach they take is expected to be bold.

EURUSD

The euro fell back below 1.07 against the dollar following Draghi’s comments this morning and while it has pared some of these losses since, we could see further downside as the day goes on. That said, we’ve seen a sizeable sell-off in the pair over the last month and today’s sell-off was not hugely significant which may suggest both ECB easing and Fed tightening is largely priced in. We could be looking at a very overcrowded trade at this stage and the lack of downward momentum, as can be seen on the MACD histogram, may suggest that more significant losses will be hard to come by. Even more hawkish comments from Fed officials today may not give the pair the push it needs to move back towards 1.0450-1.05, this year’s lows.

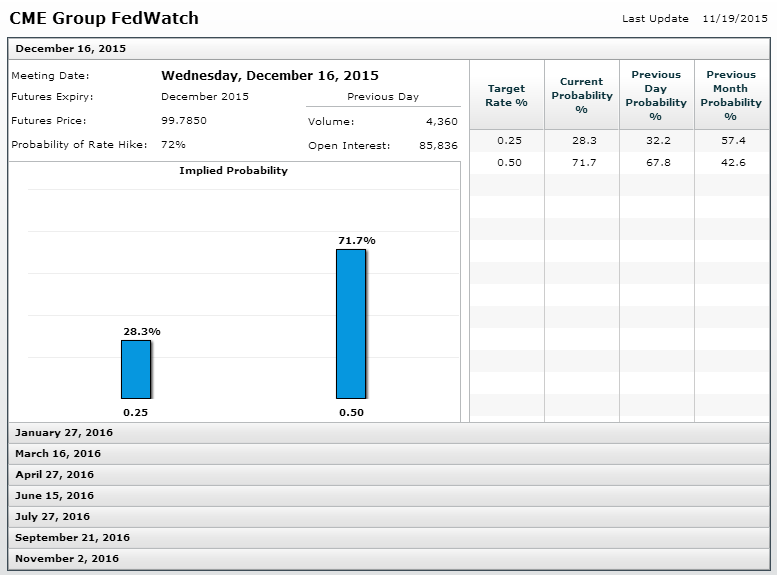

According to Fed Funds futures, a December rate hike is now 72% priced in and I wonder how much higher that can go.

EURGBP

The euro has also come under more pressure against the pound but again, it was not significant enough to force the pair through this week’s 0.70 support, which is proving to be a key psychological level. Clearly plenty of downward pressure remains here but buyers continue to come in at 0.70 and I think it’s going to take something very significant at this stage to break it, possibly an indication of the size of the ECBs stimulus package. Of course this is a two way trade and bullish news for the pound could force the move but I also don’t see this coming today. If the level is broken then the next notable support could come at this year’s lows around 0.6940-0.6950.

The S&P is expected to open 6 points higher, the Dow 64 points higher and the Nasdaq 17 points higher.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.