The rout in commodity markets will remain front and centre on Tuesday, as a lack of economic data leaves investors solely focused on the rapid sell-off. That said, this is a very busy week as a whole so investors are likely to be more than aware of what’s to come, most notably Friday’s US jobs report and Thursday’s Bank of England rate decision and inflation report.

Yesterday’s sell-off was triggered by the weak PMI readings from China that once again highlighted the challenging conditions in the country and difficulties facing the government and central bank in overcoming it. The recent sell-off in the equity markets in China appears to have created the latest wave of uncertainty for the country although efforts are now being made to prevent such enormous market shocks.

The latest intervention by authorities attempts to prevent speculators from borrowing and repaying stocks within a day. The idea is that this will prevent traders from profiting from short-term declines in the market which is believed to have contributed to some of the huge daily declines in Chinese stocks.

Weakness in the Chinese economy remains though and against the backdrop of a strengthening dollar environment, commodity prices are likely to remain under a lot of pressure. The decline in prices so far though has been substantial, Brent crude is only around $4 above its 2015 lows hit in January, while copper – particularly sensitive to changes in China – is at a six year low. Brent has taken out some key technical supports and momentum remains in its favour. We may see some stabilisation but I think we could see this year’s lows tested quite soon.

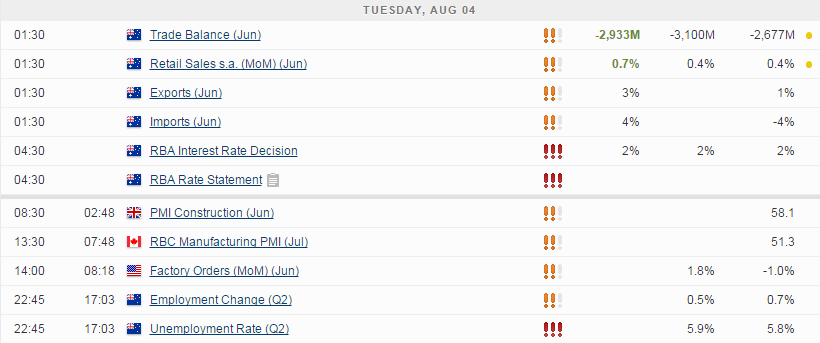

The latest UK construction PMI will be released this morning and is expected to rise to 58.6 from 58.1, which when you consider that the latest GDP data showed the contribution from the sector as being flat, may be quite surprising. Then again, this is a forward looking indicator which may suggest it will contribute more in the second half of the year.

Spanish unemployment is expected to register another decline in July, the seventh this year with February being the only positive month. This comes as the economy continues to improve following years of austerity, rising unemployment and economic reform.

The Reserve Bank of Australia deciding to leave rates unchanged at record lows of 2% over night despite the threat to the economy that plunging commodity prices brings. The statement did suggest that further declines in the currency seems likely and necessary given what’s happening to commodity prices. It also claimed that it sees inflation consistent with its target but growth is seen below the longer-term average. All in all, it was not a particularly dovish statement but it clearly leaves the door open to further rate cuts if commodity prices continue to decline and the aussie dollar doesn’t reflect the moves.

The FTSE is expected to open 15 points lower, the CAC 10 points lower and the DAX 22 points lower.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.