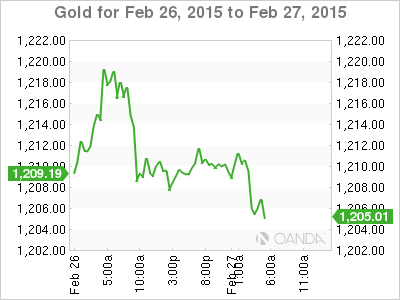

Gold has shown limited movement on Friday, as the spot price stands at $1205.02 in the European session. On the release front, the US will issue its second estimate of GDP for Q4, with a forecast of 2.1%. This is lower than the initial estimate of 2.6% in January. We’ll also get a look at Revised UoM Consumer Sentiment and Pending Home Sales.

Thursday’s US inflation and job numbers were not impressive. US inflation indicators continue to struggle. CPI posted a third straight decline, coming in at -0.7%. This was very close to the forecast of -0.6%. Core CPI improved to 0.2%, edging above the estimate of 0.1%. On the employment front, there was disappointing news, as Unemployment Claims jumped to a 6-week high, coming in at 313 thousand. This was much higher than the estimate of 288 thousand.

Greece and its international creditors have agreed to extend the bailout agreement after Greece’s list of economic reforms was accepted by the country’s creditors on Tuesday. Under this agreement, the Greek government has promised to continue with privatization plans and to meet budget targets. Still, the extension is a stop-gap measure and with sharp differences remaining between Greece and its creditors, the bailout crisis is far from over. If Greece and Germany again lock horns and raise doubts about whether Greece will remain in the Eurozone, we could see the euro lose ground.

Janet Yellen testified before Congressional committees on Tuesday and Wednesday, saying that the Fed was “unlikely” to raise interest rates in the next few months, given current economic conditions. Her remarks seemed aimed at quelling rising speculation about a rate hike sometime in mid-2015, which has helped boost the US dollar’s performance against its major rivals. Yellen noted that the continuing economic growth should lead to unemployment continuing to fall, but wages and inflation need to move higher before the Fed raises interest rates.

XAU/USD 1205.02 H: 1212.36 L: 1204.73

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price is defending support at $1.80 as multiple technical indicators flash bearish. 21.67 million MANTA tokens worth $44 million are due to flood markets in a cliff unlock on Thursday.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.