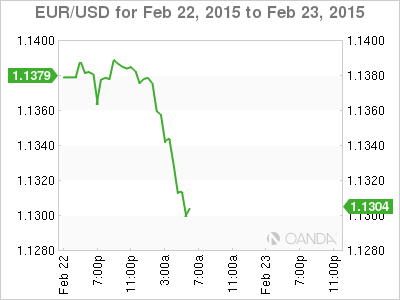

EUR/USD has started the new trading week with losses, as the pair trades just above the 1.13 line in Monday’s European session. It’s a quiet day on the release front, with only two events on the calendar. German Ifo Business Climate was almost unchanged at 106.7 points, but this was below the estimate of 107.4 points. In the US, today’s sole event is Existing Home Sales, with an estimate of 5.03 million.

Eurozone manufacturing numbers were a disappointment on Friday, as French and German manufacturing PMIs fell short of their estimates. French Flash Manufacturing PMI slipped to 47.7 points, short of the forecast of 49.7 points. The index has been below the 50-point level since April, pointing to ongoing contraction. The German PMI was almost unchanged at 50.0 points, but this was shy of the estimate of 51.8 points.

The Greek saga continues, as Greece and its creditors try to find some common ground on a bailout extension. Greece was granted a four-month extension on Friday, provided that the country could provide a list of “reform commitments” showing that Greece would continue to reform its economy. Greece’s creditors will review the proposals on Tuesday before giving their approval to the extension. Even if this occurs, the extension is a stop-gap measure and the bailout crisis is far from over.

Last week, the ECB took a major step aimed at improving transparency, as the central bank published a summary of its January policy meeting, the first time the Bank has done so. At the January meeting, the ECB decided that it would implement a massive QE program in March, with purchases of EUR 60 billion each month. The summary did not contain any surprises, but did note that ECB policymakers had discussed a EUR 50 billion QE scheme before deciding to set the amount at EUR 60 billion each month. The summary release puts the ECB more in line with major central banks such as the Federal Reserve and BOJ, which publish minutes of each policy meeting.

EUR/USD 1.1310 H: 1.1394 L: 1.1296

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.