The Japanese yen is almost unchanged on Wednesday, as USD/JPY trades in the mid-119 range. On the release front, the BOJ released its policy statement, with the BOJ saying that it would maintain its accommodative monetary stance. Later in the day, Japan releases Trade Balance. In the US, it’s a busy day, with the release of Building Permits and PPI. The highlight of the day is the Federal Reserve minutes.

There were no surprises from the BOJ policy statement, as the central bank said that it would continue to increase base money by 80 trillion yen/year. With inflation sagging and well short of the BOJ’s 2% target, the central bank has little choice but to continue its accommodative monetary stance. The divergence with the Federal Reserve, which is expected to raise rates, will likely continue to weigh on the Japanese yen, which is again flirting with the symbolic 120 level.

Japanese manufacturing data started the week on a positive note, as Revised Industrial Production gained 0.8%, bouncing back from a decline in the previous release. This was within expectations, as the estimate was 1.0%. Last week, Japanese Core Machinery Tools jumped 8.3% in December, its strongest gain since March. This easily beat the estimate of 2.4%.

The markets are keeping a close eye on the Fed minutes, which will be released later on Wednesday. With the US economy showing strong growth and positive employment numbers, there are widespread expectations for a rate hike as early as the summer. Any hints regarding a hike could provide a strong boost for the US dollar against its major rivals.

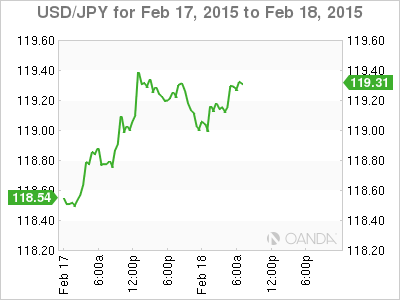

USD/JPY 119.36 H: 119.41 L: 118.88

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD pressured as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.