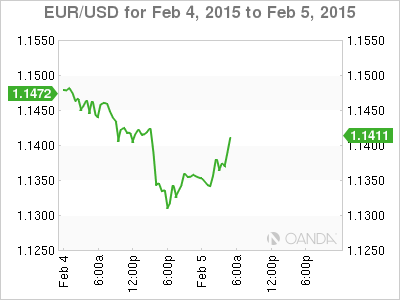

The euro has gained over 100 points on Thursday, reversing the direction we saw a day earlier. In the European session, EUR/USD is trading in the low-1.14 range. On the release front, German Factory Orders was excellent, posting a gain of 4.2%. In the US, today’s major events are Trade Balance and Unemployment Claims.

Are Greece and its international creditors on a collision course? The new Greek government has declared that it will not honor the current bailout agreement and has put a halt to the sale of major public assets to help pay back debt. The ECB hit back late Tuesday, saying that it would no longer accept Greek government bonds as collateral for ECB loans. This will put pressure on Greek banks and serves as a warning that the ECB will idly stand by as Greece tries to avoid its bailout obligations. The drama will continue next week, as German Chancellor Angela Merkel and Greek Prime Minister Alexis Tsipras attend an EU meeting in Brussels next week.

In the US, ADP Non-Farm Employment Change was well off expectations, falling to 213 thousand. The estimate stood at 224 thousand. The markets are bracing for more bad news on Thursday, as Unemployment Claims are expected to rise to 287 thousand. If the forecasts prove correct that the labor market has started off 2015 on a weak note, we could see the US dollar lose ground.

German Factory Orders impressed in December, jumping 4.2%, crushing the estimate of 1.4%. Earlier in the week, there was good news from PMI reports, as Spanish, Italian and Eurozone Services PMIs all improved in January. All three readings were above the 50 level, indicative of expansion in the services sector. Meanwhile, Retail Sales, the primary gauge of consumer spending, weakened to 0.3% in December, down from 0.6% a month earlier. The indicator managed to beat the forecast of -0.1%.

EUR/USD 1.1436 H: 1.1396 L: 1.1316

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.