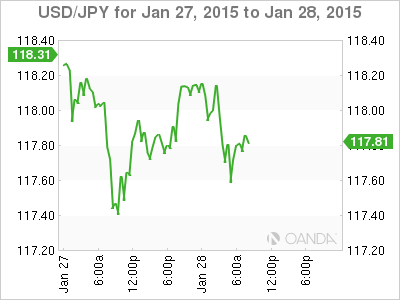

The Japanese yen has been marked by choppy trade on Wednesday, as USD/JPY trades just shy of the 118 line early in the North American session. On the release front, Japan will release Retail Sales later in the day. The markets are expecting a strong rebound of 1.1% in the January release. In the US, the markets are keeping a close eye on the FOMC Statement. The only other event is Crude Oil Inventories, with the markets expecting a strong downturn in the upcoming report.

The Federal Reserve will be in the spotlight on Wednesday, with the release of a policy statement at the end of a two-day meeting. The Fed is expected to continue to counsel patience regarding an interest rate hike, and persistently weak inflation means the Fed can take its time before having to make a monetary move. The markets will be combing through the statement and any clues as to the timing of rate hike could shake up the currency markets.

There was mixed numbers out of the US on Tuesday. Durable Goods Orders plunged 3.4%, marking a 4-month low. There was no relief from Core Durable Goods Orders, which declined by 0.8%, its fifth drop in six readings. The markets had expected gains from both indicators. There was much better news later in the day, as CB Consumer Confidence jumped to 102.9 points, crushing the estimate of 95.3 points. New Home Sales followed suit, rising to 481 thousand, well above the forecast of 452 thousand.

Japanese corporate inflation remained steady in December, as the Services Producer Price Index posted a gain of 3.6%. The index has now posted identical gains for three consecutive months. There was good news earlier in the week, as the Japanese trade deficit narrowed sharply in December. The deficit dropped to JPY 0.71 trillion, slightly below the estimate of 0.74 trillion and its lowest reading since June 2013.

USD/JPY 117.90 H: 118.26 L: 117.55

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.