The Federal Reserve will be in the spotlight on Wednesday, with the release of policy statement at the end of a two-day meeting. The Fed is expected to continue to counsel patience regarding an interest rate hike, and persistently weak inflation means the Fed can take its time before having to make a monetary move. The markets will be combing through the statement and any clues as to the timing of rate hike could shake up a listless EUR/USD.

It’s been strong week for German confidence indicators. GfK German Consumer Climate improved to 9.3 points, edging above the estimate of 9.2 points. The key indicator has now risen for four consecutive releases, as the German consumer remains optimism. This follows an excellent business confidence report. German Ifo Business Climate rose for a fourth straight month, hitting 106.7 points which matched the estimate. This marked a six-month high.

Greece remains in the headlines, as voters gave a sweeping mandate to the far-left Syriza party. Syriza ran on a platform of ending the crushing austerity scheme which Greeks have endured as part of the €240 billion bailout negotiated between and the EU, ECB and IMF. Syriza’s win certainly throws a monkey wrench into the Greek bailout program, but the new Greek government is likely to negotiate a deal with Greece’s creditors. A Greek exit from the Eurozone a most unlikely scenario. Indeed, Greek Prime Minister-elect Alexis Tsipras has promised to keep Greece in the Eurozone. Still, there remains plenty of uncertainty as to what will happen with the bailout plan, so traders can expect events in Athens to have a strong impact on the movement of the euro.

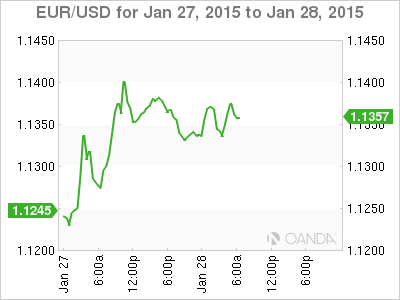

EUR/USD 1.1365 H: 1.1382 L: 1.1326

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.