EUR/USD is showing little movement on Wednesday, as the pair trades in the high-1.15 range in the European session. There are no Eurozone releases today, but the markets will be counting down the hours until the ECB policy meeting on Thursday, which is likely to see a QE announcement. In the US, it’s been a very quiet week. We’ll get a look at the first major events of the week, with the release of Building Permits and Housing Starts for December. The markets are expecting slight improvement from both indicators.

As the markets nervously eye the ECB policy meeting on Thursday, is this the calm before the storm? On Wednesday, French President Francois Hollande stated flat out that the ECB will announce a quantitative easing package at the ECB meeting. However, now that a QE is likely priced in, the question remains what will be the size of the program? The markets are anticipating QE of between EUR 500-600 billion, but some market players are saying that the ECB could go as high as EUR 800 billion. Will the euro take a hit on Thursday? The likelihood is yes, unless the ECB surprises with a “QE lite”, such as EUR 300 billion, which would be well below expectations.

There was excellent news out of Germany on Wednesday, as ZEW Economic Sentiment climbed to 48.4 points, crushing the estimate of 40.1 points. This marked the indicator’s highest level in 11 months, pointing to strong optimism among German investors and analysts. Eurozone Economic Sentiment, improving to 45.2 points. This easily surpassed the forecast of 37.6 points. The news was not as positive on the inflation front, as German PPI dropped 0.7%, its worst showing since April 2009. With the Eurozone struggling with deflation, there is growing expectation that the ECB will announce a QE package at its policy meeting on Thursday.

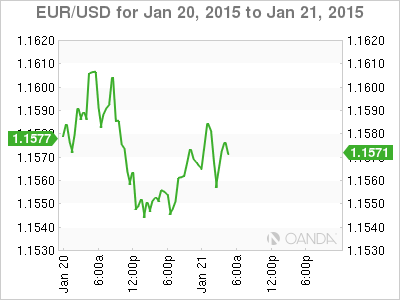

EUR/USD 1.1571 H: 1.1588 L: 1.1542

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.