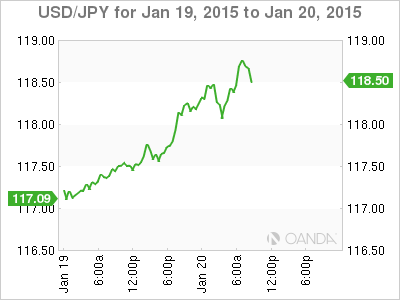

The Japanese yen has posted losses on Tuesday as USD/JPY trades in the mid-118 range on Tuesday. It’s a quiet day on the release front, with NAHB Housing Market Index the sole indicator on the calendar. There are no Japanese releases on Tuesday, but the BOJ will release its monthly policy statement early on Wednesday. In China, GDP remained steady at 7.3% in Q4.

USD/JPY moved higher on Tuesday, as Chinese GDP came in at 7.3% for Q4, edging above the estimate of 7.2%. This eased worries about a slowdown in China, the world’s second largest economy, as GDP kept up with its pace in Q3. The yen was trading below the 116 line last week, but has taken a beating since then, surrendering about 250 points.

It has been less than a week since the SNB stunned the markets by suddenly removing its cap with the euro. However, the markets have had to quickly change focus, as there is growing anticipation that the ECB will announce a QE package on Thursday, when the ECB meets for a crucial policy meeting. The Eurozone has been plagued by deflation and weak growth, and the SNB shocker only reinforces the belief that the ECB will finally make a move. Even if QE has been priced in, there’s no way to know the size of such a scheme, so traders could be in for further volatility in the currency and commodity markets later in the week.

USD/JPY 118.54 H: 118.77 L: 117.70

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.