USD/JPY is steady on Thursday, following huge gains by the pair a day earlier. At the start of the North American session, USD/JPY is trading at the 119 line. On the release front, US Unemployment Claims dropped to 287 thousand, beating expectations. Later in the day, the US releases the Philly Fed Manufacturing Index. There are no Japanese releases on Thursday, but the BOJ will release a policy statement early on Friday. An unexpected announcement could cause some movement from USD/JPY.

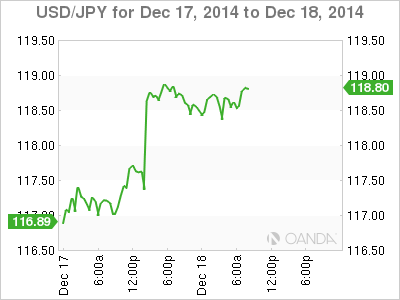

The Japanese yen took a tumble on Wednesday after the Federal Reserve policy statement. Previous Fed policy statements have usually stated that the Fed would maintain low rates for a “considerable time”, but the December statement changed emphasis, saying the Fed would be “patient” before raising rates. In a follow-press conference, Federal Reserve chair Janet Yellen was less ambiguous, saying that the Fed was unlikely to raise rates for the “next couple of meetings”. The markets took this to mean that a rate hike is in the works, but not before April. The yen was down sharply on the news as USD/JPY gained about 130 points on Wednesday.

Prime Minister Shinzo Abe received a new mandate on the weekend, as the ruling Liberal Democratic Party swept to victory in parliamentary elections, winning a comfortable majority in the lower house of parliament. However, Abe has been hard-pressed to prop up the weak economy and he was recently forced to scrap a controversial sales tax hike. Growth and inflation remain well below the government’s target and the BoJ’s radical monetary easing scheme has ravaged the yen, which remains close to the 120 level. With the BOJ expected to maintain or even ease its monetary stance, we’re unlikely to see much improvement from the Japanese currency in the near future.

USD/JPY 118.99 H: 119.00 L: 118.26

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 after US data

EUR/USD stays in a consolidation phase below 1.0700 in the early American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold trades on the back foot, manages to hold above $2,300

Gold struggles to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to reverse its direction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.