The dollar has posted gains on Wednesday, as USD/JPY trades in the low-117 range on Wednesday. On the release front, the Federal Reserve will release its policy statement, and we’ll get a look at November CPI. The markets are expecting a small decline of 0.1%. There are no Japanese releases on Wednesday.

In the US, Tuesday’s data was a disappointment. Building Permits dropped to 1.04 million, short of the estimate of 1.06 million. Housing Starts rose slightly to 1.04 million, shy of the estimate of 1.06 million. The Manufacturing PMI dipped to 53.7 points, well off the forecast of 56.1 points. This was the indicator’s worst showing since January.

The yen has served as an unwilling punching bag for the US dollar for months, and last week USD/JPY pushed above the 121 line. However, the Japanese currency has turned the tables this week, as the yen has gained 200 points on Tuesday. The safe-haven yen took advantage of a dip in the Chinese Flash Manufacturing PMI, which came in at 49.5 points. This pointed to contraction in the PMI for the first time since May and raises concerns about continuing weakness in the global economy.

Japan’s ruling Liberal Democratic Party registered a convincing election victory on the weekend, giving Prime Minister Abe a comfortable majority in the lower house of parliament. However, winning the election is likely to be the easy part, as the economy is stumbling and Abe’s economic reforms will face resistance from the upper house. Growth and inflation have not met the government’s target and the yen has tumbled to around 120 under “Abenomics”, with the BoJ implementing radical monetary easing. Meanwhile, the Japanese Tankan indices were a mix in the Q3 readings. The Manufacturing Index dipped to 12 points, down from 13 points in Q2. There was better news from the Non-Manufacturing Index, improving to 16 points, up from 14 points in Q2. The yen showed little response to these key releases.

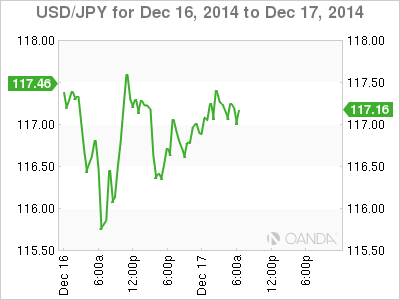

USD/JPY 117.19 H: 117.50 L: 116.45

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.