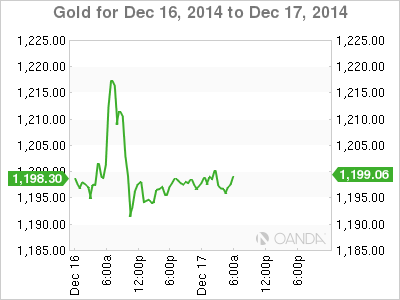

Gold is showing little movement, as the pair has been listless since sharp losses started off the week. In the European session, the spot price stands at $1198.03. In the US, the FOMC will release its policy statement, and we’ll get a look at November CPI. The markets are expecting a small decline of 0.1%.

Gold prices started the week with losses, as the metal shed about 1.8% of its value on Monday, closing at $1198. Gold continues to trade close to the key $1200 level on Tuesday. Why the sharp drop on Monday? One reason is last week’s US numbers, as solid employment and retail sales numbers helped boosted the dollar. As well, the markets are expecting a bullish view of the US economy from the Federal Reserve policy statement on Wednesday.

In the US, UoM Consumer Sentiment moved higher for a fourth straight month, pointing to increased optimism among US consumers. The key indicator soared to 93.8 points, its highest level since January 2007 and well above the forecast of 89.6 points. Earlier in the week, there was good news from retail sales and jobless claims. Core Retail Sales came in at 0.5%, ahead of the estimate of 0.1%. Not to be undone, Retail Sales posted a gain of 0.7%, beating the estimate of 0.4%. This was the indicator’s strongest showing in 12 months. There was more good news on the job front, as Unemployment Claims dipped to 294 thousand, below the forecast of 299 thousand.

XAU/USD 1198.03 H: 1201.67 L: 1194.49

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.