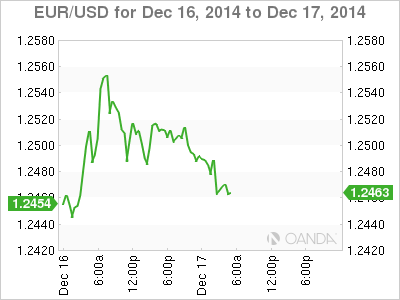

EUR/USD is steady on Wednesday, as the pair trades in the mid-1.24 range in the European session. On the release front, Eurozone CPI edged lower to 0.3%, matching the forecast. In the US, the FOMC will release its policy statement, and we’ll get a look at November CPI. The markets are expecting a small decline of 0.1%.

The Federal Reserve will be in the spotlight on Wednesday, as the FOMC issues its monthly policy statement. With the US economy continuing to grow, the markets are confident that the Fed will take action and raise interest rates in the first half of 2015. One key question is whether the Fed will adjust its forward guidance; that is, will the Fed make use of policy statements to provide the markets with more information about its projections regarding interest rate policy. If this does occur, there will be less uncertainty about the Fed’s monetary policy and this could boost the US dollar against its major rivals.

Eurozone inflation remains at low levels, and there were no surprises as Eurozone CPI dipped to 0.4% in November, down from 0.4% a month earlier. Persistent efforts from the ECB have not improved matters, and the danger of deflation has risen with the crash in oil prices. Germany, the locomotive of the Eurozone, has not been immune to weak inflation, with German Final CPI coming in at a flat 0.0% in November.

The week started off on a positive note in the Eurozone, as German Manufacturing PMI improved to 51.2 points, up from 50.0 points a month earlier. A reading above the 50-point level indicates expansion. The Eurozone released improved to 50.8 points, up from 50.4 points. French Manufacturing PMI showed little change, coming in at 47.9 points. The index has been under 50 since April, indicative of ongoing contraction. Services PMIs were mixed, as the German release weakened, while the Eurozone and French readings improved.

EUR/USD 1.2450 H: 1.2515 L: 1.2449

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD remains under pressure above 0.6400

AUD/USD managed to regain some composure and rebounded markedly from Tuesday’s YTD lows in the sub-0.6400 region ahead of the release of the Australian labour market report on Thursday.

EUR/USD holds above 1.0650 amid renewed selling pressure in US Dollar

The EUR/USD pair edges higher to 1.0672 on Thursday during the early Asian session. The recovery of that major pair is bolstered by renewed selling pressure in the US Dollar and a risk-friendly environment.

Gold retreats as lower US yields offset the impact of hawkish Powell speech

Gold prices retreated from close to weekly highs during the North American session on Wednesday amid an improvement in risk appetite. The bullish impulse arrived despite hawkish commentary by US Federal Reserve officials.

Bitcoin price uptrend to continue post-halving, Bernstein report says as traders remain in disarray

Bitcoin price is dropping amid elevated risk levels in the market. It comes as traders count hours to the much-anticipated halving event. Amid the market lull, experts say we may not see a rally until after the halving.

Australia unemployment rate expected to rise back to 3.9% in March as February boost fades

Australia will publish its monthly employment report first thing Thursday. The Australian Bureau of Statistics is expected to announce the country added measly 7.2K new positions in March after the outstanding 116.5K jobs created in February.