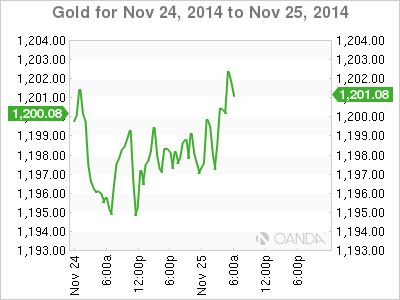

Gold is showing little movement on Tuesday, as the spot price stands at $1202 per ounce. On the release front, there are two key events on the schedule – Preliminary GDP and CB Consumer Confidence.

All eyes are on US GDP for Q3, which will be released later on Tuesday. The markets are expecting a strong gain of 3.3%. This is not as strong as the Q2 release, which posted a gain of 4.2%. If the indicator meets or exceeds expectations, we could see the US dollar post gains in the North American session.

The euro hasn’t had much to cheer about lately, and the currency took a tumble on Friday, losing over 150 points. This was a result of remarks from ECB head Mario Draghi, who warned that that inflation expectations were declining to levels that were very low and said the ECB is ready to expand its stimulus program. Deep interest rate cuts haven’t boosted growth or inflation, so the ECB has reached deeper into its toolbox and purchased covered bonds and asset-backed securities. So far, these purchases have been from the private sector, but the ECB could decide to expand these purchases to government bonds, known has quantitative easing (QE). However, there is strong resistance to QE from national central banks, such as the powerful German Bundesbank.

XAU/USD 1202.02 H: 1202.95 L: 1195.75

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.