Gold has posted modest gains on Thursday, recovering losses sustained a day earlier. On the release front, it’s a very busy day, with four key indicators – Core CPI, CPI, Unemployment Claims and the Philly Fed Manufacturing Index. Any unexpected readings from these events could translate into some volatility from EUR/USD.

The Federal Reserve released its minutes on Wednesday and there were no clues about the timing of a rate hike. The markets are expecting rates to rise in the second half of 2015, but this will of course depend on economic conditions. With inflation below the Fed target of 2%, there is less pressure to raise rates. The minutes also noted that that weak economic outlooks in Europe and Japan are unlikely to have a negative impact on the US economy.

The ECB hasn’t had much success in kick-starting the ailing Eurozone economy. Deep interest rate cuts haven’t boosted growth or inflation, so the ECB has reached deeper into its toolbox and purchased covered bonds and asset-backed securities. So far, these purchases have been from the private sector, but the ECB could decide to expand these purchases to government bonds, known has quantitative easing (QE). However, there is strong resistance to QE from national central banks, such as the powerful German Bundesbank. Speaking before a European parliamentary committee on Monday, Draghi said that QE remains at option. If the ECB does decide to make such a move, the wobbly euro could lose more ground.

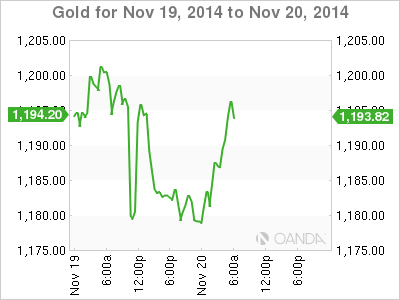

XAU/USD 1192.79 H: 1197.13 L: 1176.82

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.