The Japanese yen continues to lose ground on Tuesday, as USD/JPY trades in the high-116 range. On the release front, Japan will release Tertiary Industry Activity. The markets are expecting good news, with an estimate of 0.9%. In the US, banks will be closed for Veterans Day, so traders can expect reduced liquidity in the currency markets.

Japanese Current Account looked solid, as the current account surplus improved to JPY 0.41 trillion. This easily beat the estimate of JPY 0.03 trillion and marked the highest surplus since August 2013. Despite the good news, the yen continues to slide, surrendering a remarkable 800 points in just two weeks. USD/JPY is close to seven-year highs, and with the BoJ increasing stimulus, the yen’s disappearing act could well continue.

Employment numbers have been strong in the US, and this played a major role in the Fed decision to wind up QE last week. However, US Nonfarm Payrolls, the most important employment indicator, disappointed on Friday. The indicator slipped to 214 thousand, well short of the estimate of 235 thousand. On a brighter note, the unemployment rate slipped to 5.8%, its lowest level in six years. On Thursday, Unemployment Claims fell to 278 thousand. This was better than the estimate of 285 thousand and marked a three-week low.

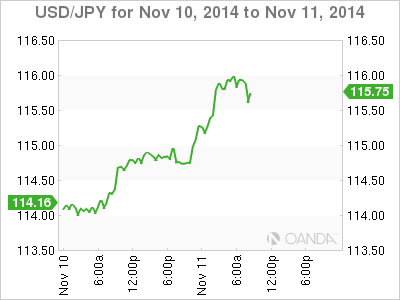

USD/JPY 115.92 H: 116.10 L: 114.64

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.