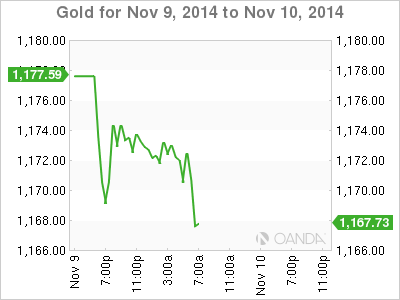

Gold is steady on Monday, following sharps gains on Friday. In the European session, the spot price stands at $1166.93. It’s a quiet day on the release front, with no US releases until Thursday.

Gold prices jumped about 3% on Friday, as the metal reversed directions following sharp losses during the week. Gold took advantage of a weak US Nonfarm Payrolls report, which were well below expectations. Gold hit a low of $1130 last week, its lowest level since April 2010.

Mario Draghi and his ECB colleagues haven’t had much to cheer about lately, with the Eurozone stuck with low growth, weak inflation and high unemployment. Draghi has lowered interest rates to the bone, but the cuts have not improved the economic situation. The ECB has decided to focus on its balance sheet and has issued long-term loans to banks and purchased covered bonds. The ECB will begin buying asset-backed purchases later this month, so we could see the wobbly euro lose more ground. However, these moves may not be enough and Draghi may be forced to borrow a page from the book of other central banks and commence quantitative easing, which is the purchase of government securities.

US Nonfarm Payrolls disappointed on Friday, as the key employment indicator slipped to 214 thousand, well short of the estimate of 235 thousand. On a brighter note, the Unemployment Rate slipped to 5.8%, its lowest level in six years. On Thursday, Unemployment Claims fell to 278 thousand. This was better than the estimate of 285 thousand and marked a three-week low.

XAU/USD 1166.93 H: 1177.74 L: 1166.64

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.