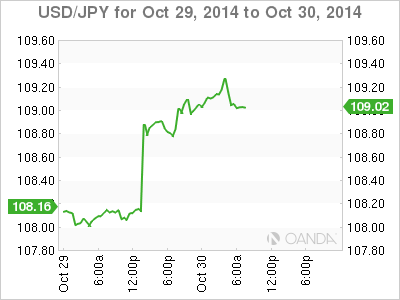

USD/JPY has moved upwards on Thursday, as the US dollar has posted broad gains following the FOMC policy statement on Wednesday. In the European session, the pair is trading just above the 109 line. On the release front, there are two major US events -GDP and Unemployment Claims. Both indicators are expected to post strong figures, so we could see the dollar post gains in the North American session. As well, Federal Reserve Chair Janet Yellen will address an event in Washington. In Japan, today’s highlights are Tokyo CPI and Household Spending.

Japanese data continues to impress this week. Preliminary Industrial Production sparkled in September, with a gain of 2.7%, compared to a reading of -1.5% a month earlier. The estimate stood at 2.3%. Earlier in the week, Japanese Retail Sales was unexpectedly strong in September, climbing 2.3%, its strongest gain since March and well above the estimate of 0.9%. There has been concern about consumer spending in Japan after the sales tax was raised in April from 5% to 8%. The government plans to increase the tax to 10%, but is wary about hurting the economy, which has been marked by modest growth. The Household Spending report later on Thursday will be an important gauge of consumer spending, a key engine of economic growth.

The US dollar posted strong gains on Wednesday, boosted by a hawkish Federal Reserve policy statement. The Fed said that the labor market is strengthening and inflation remains on target, although it did note that the labor market participation rate remains low. As expected the Fed completed the taper of its QE3 program. The asset-purchase program was initially started in 2008, at the height of the economic crisis, in order to boost a weak US economy. The termination of the QE is a symbolic step which is a vote of confidence from the powerful Fed that the US economy is on the right track.

US durable goods looked dismal in September. Core Durable Goods Orders dropped 0.2%, its second decline in three months. This was well short of the estimate of 0.5%. Durable Goods Orders followed suit with a decline of -1.3%. This was a second straight decline, and missed the estimate of 0.4%. There was much better news from CB Consumer Confidence, as the indicator climbed to 94.5 points, up sharply from 86.0 points. This easily beat the estimate of 87.4 and marked a 7-year high. An increase in consumer confidence usually translates into stronger consumer spending, which is a critical component for economic growth.

USD/JPY 109.10 H: 109.31 L: 108.84

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.