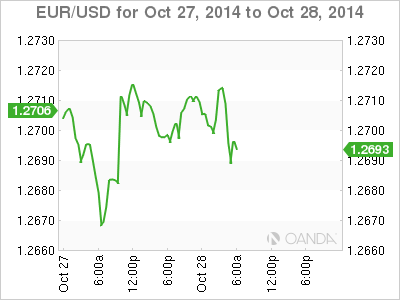

EUR/USD continues to show little activity on Tuesday, as the pair trades slightly below the 1.27 line in the European session. On the release front, German Import Prices beat the estimate with a gain of 0.3%. In the US, there are two key events on the schedule – Core Durable Goods Orders and CB Consumer Confidence. So we could see some stronger movement from the pair following the release of these events in the North American session.

German Ifo Business Climate continues to weaken, as the indicator dipped to 103.2 points in September. This was short of the estimate of 104.6 points and marks the sixth straight release that the indicator has lost ground. German GDP contracted in Q2, and another contraction in Q3 would indicate a recession in the Eurozone’s largest economy. German growth has been hurt as exports have been hit by EU sanctions against Russia, weak Eurozone demand and slower growth in China, Germany’s third largest trading partner.

On Sunday, the ECB released the results of its stress tests of European banks. The exercise marked a comprehensive and rigorous review of the health of 130 European banks. No German or French banks failed the test, but the third largest Italian lender, Banca Monte Paschi, posted a capital shortfall and will have to explain to the ECB how its plans to eliminate the shortfall. The ECB is trying to restore confidence in the European banking sector and encourage more borrowing and spending on the part of consumers and businesses.

In the US, the Federal Reserve wraps up a two-day meeting on Wednesday with the release of a policy statement. The Fed is expected to wind up QE, and if policymakers delay this move, the dollar will likely take a hit against its major rivals. The markets will also be looking for hints regarding the timing of a rate hike, which is expected sometime in 2015. Traders should treat this release as a market-mover which could have a significant impact on the direction of EUR/USD.

EUR/USD 1.2688 H: 1.2719 L: 1.2686

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.