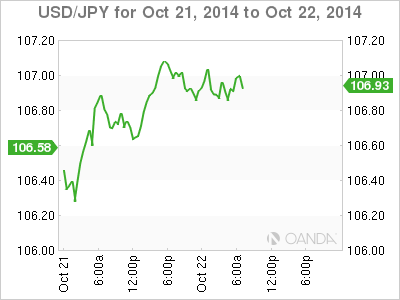

The Japanese yen is showing little activity on Wednesday, as USD/JPY trades just below the 107-range in the European session. In Japan, Trade Balance disappointed on Tuesday, posting a larger deficit than expected. There are no Japanese releases on Wednesday. Over in the US, today’s highlights are CPI and Core CPI. The markets are keeping expectations low for the September readings.

Although US economic numbers have been strong overall, the lack of inflation remains a serious concern. Last week, PPI slipped to -0.1%, its first decline in four months. We’ll get a look at consumer inflation numbers on Wednesday, with the release of Core CPI and CPI. Soft figures would be an indication of weak consumer demand, which could hamper the US recovery.

On Monday, BoJ Governor Haruhiko Kuroda stated that Japan’s economy continues to improve modestly, although consumer demand has lessened since the consumption tax hike in April. The BoJ would prefer to stay on the sidelines, but there has been talk that the central bank could step in with additional stimulus if the economy takes a turn for the worse. Such a move would weigh on the already weak Japanese yen.

USD/JPY 106.94 H: 107.07 L: 106.79

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

How will US Dollar react to Q1 GDP data? – LIVE

The US' GDP is forecast to grow at an annual rate of 2.5% in the first quarter of the year. The US Dollar struggles to find demand as investors stay on the sidelines, while waiting to assess the impact of the US economic performance on the Fed rate outlook.

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.