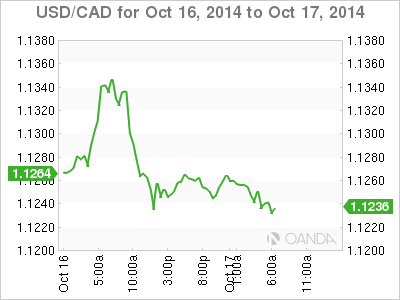

The Canadian dollar is steady on Friday, as USD/CAD trades in the mid-1.12 range. We could see some volatility from the pair, with a host of key events on the schedule. Canada releases Core CPI and CPI. In the US, it’s another busy day, with the release of Building Permits and the UoM Consumer Sentiment. As well, Federal Reserve Chair Janet Yellen will deliver remarks at an event in Boston.

Canadian manufacturing data was a big disappointment, as Manufacturing Sales tumbled 3.3%, well of the estimate of -1.6%. This marked the key indicator’s biggest drop in over five years. The Canadian dollar did soften after the release, and was fortunate to close the day almost unchanged. Elsewhere, Foreign Securities Purchases posted a strong reading of 10.3 billion C$, easily exceeding the estimate of 4.31 billion.

Earlier in the week, US retail sales and inflation numbers sagged. Core Retail Sales dipped 0.2%, its first decline since April 2013. It was a similar story with Core Retail Sales, which posted a decline of 0.3%, its first loss since January. This points to a decrease in consumer spending, a key component of economic growth. Meanwhile, PPI fell by 0.1%, after a reading of 0.0% a month earlier. All three events missed their estimates.

There was better news on Thursday, as US Unemployment Claims dropped to 264 thousand, marking a 14 -year low. The estimate stood at 286 thousand. Manufacturing numbers were a mix, as Industrial Production gained 1.0%, its best showing since November. The Philly Fed Manufacturing Index dipped to 20.7 points, but this beat the estimate of 19.9 points.

USD/CAD 1.1232 H: 1.1267 L: 1.1228

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.