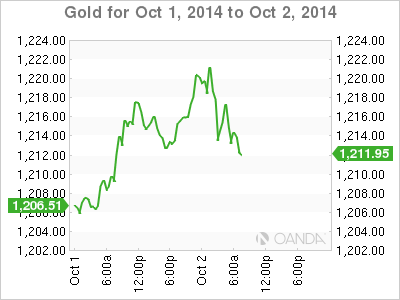

Gold is showing movement on Thursday, as the spot price stands at $1211.28 per ounce late in the European session. On the release front, the ECB maintained the benchmark interest rate at 0.05%. The markets are waiting for Mario Draghi’s press conference, at which the ECB head is expected to discuss details of an asset-based securities program (ABS). In the US, Unemployment Claims looked solid, dropping to 287 thousand.

Recent sharp gains by the US dollar are weighing on gold prices, as a stronger dollar diminishes the metal’s appeal as an alternative asset to the dollar. The dollar has enjoyed a spectacular September, and gold prices have tumbled over 6% during this period. With the Fed scheduled to wind up QE and attention shifting to the timing of an interest rate hike, gold could continue to move lower.

As expected, the ECB did not adjust interest rates, leaving the benchmark rate at a record low of 0.05%. The ECB is feeling the pressure to take further measures, but as Mario Draghi knows all too well, there isn’t any magic formula to creating inflation and improving economic growth. The ECB head has pledged to introduce an asset-backed securities (ABS) scheme starting this month, but the markets have low expectations, anticipating asset purchases to be modest.

In the US, ADP Nonfarm Payrolls surprised with a strong gain, climbing to 213 thousand, compared to 204 thousand in the previous release. This beat the estimate of 207 thousand. The ADP release precedes the official NFP release, which will be published on Friday. The markets are anticipating a sharp gain, with an estimate of 216 thousand. If the indicator does follow suit with a solid reading, the US dollar could post further gains against its major rivals.

On the manufacturing and housing fronts, this week’s numbers were disappointing. ISM Manufacturing PMI fell to 56.6 points, down from 59.0 points a month earlier. US Pending Home Sales posted a decline of 1.0%, compared to last month’s gain of 3.3%. On Friday, we’ll get a look at ISM Non-Manufacturing PMI, with the markets braced for a softer reading for September.

XAU/USD 1211.28 H: 1222.34 L: 1210.48

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.