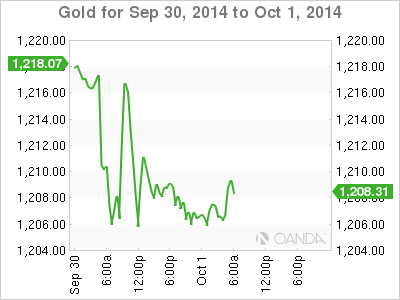

Gold prices are showing little change on Wednesday, as the metal remains under pressure from the strong US dollar. In the European session, the spot price stands at $1208.93 per ounce. There are two key releases on the calendar – ADP Non-Farm Employment Change and ISM Manufacturing PMI. The markets are not expecting significant changes from last month’s readings.

Recent sharp gains by the US dollar are weighing on gold prices, as a stronger dollar diminishes the metal’s appeal as an alternative asset to the dollar. The dollar has enjoyed a spectacular September, and gold prices have tumbled over 6% during this period. With the Fed scheduled to wind up QE and attention shifting to the timing of an interest rate hike, gold could continue to move lower.

The markets are keeping a close eye upcoming US employment numbers, starting with ADP Nonfarm Payrolls later on Wednesday. The estimate stands at 207 thousand, little changed from 204 thousand. The ADP release precedes the official NFP release which will be published on Friday. The markets are anticipating a sharp gain, with an estimate of 216 thousand. If the indicator does follow suit with better numbers this month, the US dollar could post further gains against its major rivals.

US Pending Home Sales posted a decline of 1.0%, compared to last month’s gain of 3.3%. The important housing indicator has shown strong movement, resulting in readings that have been well off market estimates. US housing indicators continue to paint a mixed picture, as New Home Sales jumped last month, while Existing Home Sales softened and was well short of expectations.

XAU/USD 1209.18 H: 1209.94 L: 1204.66

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.