The Japanese yen is calm at the start of the new trading week, as the pair trades in the mid-109 range on Monday. Japan will release three important indicators later in the day – Household Spending, Preliminary Industrial Production and Retail Sales. Any unexpected readings could shake up USD/JPY. Over in the US, today’s highlight is Pending House Sales. After a sharp gain of 3.3% in July, the markets are braced for a sharp downturn, with an estimate of -0.4%.

Japanese inflation releases continue to look strong, as underscored by the August numbers. Tokyo Core CPI, the primary gauge of consumer inflation, posted a strong gain of 2.6%, just shy of the estimate of 2.7%. National Core CPI and the Services Producer Price Index, which measures corporate inflation, also met expectations. The elimination of deflation, which hobbled the Japanese economy for years, has been a key platform for the government and BoE, and this has been largely achieved, as inflation levels have dramatically risen in the past year.

In the US, Core Durable Goods Orders posted a strong gain of +0.7%, bouncing back from the previous reading of -0.8%. Durable Goods Orders continues to take its riders on a roller coaster ride, plunging 18.2% in August, compared to a huge gain of 22.6% a month earlier. Unemployment Claims rose to 293 thousand, within expectations.

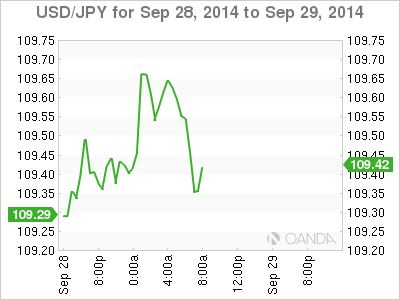

USD/JPY 109.37 H: 109.74 L: 109.26

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.