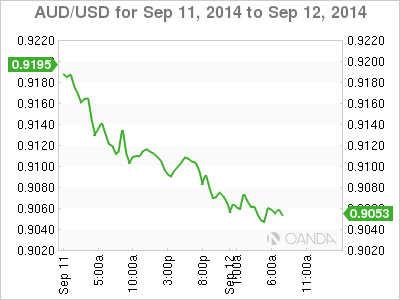

The Australian dollar's miseries continue, as AUD/USD has lost more ground on Friday. In the European session, the pair is trading in the mid-0.90 range, its lower level since March. The Aussie has had a dismal week, surrendering over 300 points. There are no Australian releases on Friday. In the US, it's a busy day with the release of three major events - Retail Sales, Core Retail Sales and UoM Consumer Sentiment.

US employment data continues to disappoint, as concerns increase regarding the health of the US job market. Unemployment Claims rose to 315 thousand, the largest number of claims in 10 weeks. The reading was much higher than the estimate of 306 thousand. This follows soft numbers from JOLTS Job Openings and a dismal Nonfarm Payrolls last week. The troubling job numbers are unlikely to affect the Fed's plan to continue trimming QE next week, but a weak labor market could postpone plans to raise interest rates by mid-2015.

Australian employment numbers made headlines on Thursday, as Employment Change posted an incredible gain of 121,000 last month, crushing the estimate of 15,000. The markets are having some difficulty accepting these stratospheric figures at face value, with one Australian analyst noting that the numbers are "somewhat difficult to interpret". The Australian statistics bureau claimed that a rotation in its survey group affected the August figures, and we're likely to hear more about the authenticity of these numbers in the next few days. There were no doubts about the veracity of the unemployment rate, which dipped to 6.1%, beating the estimate of 6.3%. The Aussie posted gains after the employment releases but then retracted and continued to head southward.

Confidence in the Australian economy appears to be waning, according to the latest business and consumer confidence data. Westpac Consumer Sentiment had been steadily improving, but the upswing came to a crashing halt as the indicator slipped by 4.6% in August. This marked a 4-month low. Earlier this week, NAB Business Confidence, a key indicator, slipped to 8 points in August, compared to 11 points a month earlier. Weak business and consumer confidence in Australia's economy could translate into decreased spending by consumers and businesses, which would be grim news for the weak economy.

The Australian dollar is sensitive to key Chinese releases, as China is Australia's biggest trading partner. Chinese Trade Balance hit a record high in August, as the surplus climbed to $49.8 billion, easily beating the estimate of $40.8 billion. Stronger Chinese exports should translate into increased demand for Australian raw materials, which bodes well for the Australian export sector and the Aussie. On Thursday, Chinese CPI came in at 2.0%, as the index fell to a 4-month low.

AUD/USD 0.9054 H: 0.9099 L: 0.9043

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.