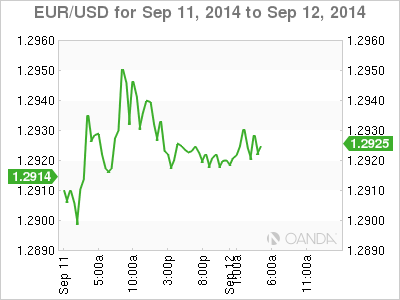

It's more of the same from the euro, which has had a quiet week and is showing very little movement on Friday. In the European session, EUR/USD is trading in the low-1.29 range. On the release front, there was yet another weak German inflation reading, as WPI came in at -0.2%. Eurozone Industrial Production posted a strong gain of 1.0%, exceeding expectations. In the US, today's highlight is UoM Consumer Sentiment. The markets are expecting a strong improvement for August after a soft reading in the previous release. Eurozone finance ministers are meeting today in Milan.

In the aftermath of some drastic monetary action by the ECB, Eurozone finance ministers will huddle in Milan on Friday to try and coordinate fiscal policy. ECB President Mario Draghi has urged Eurozone members to more to increase growth, and there's no arguing that the sputtering Eurozone economy has taken its toll on individual member states. However, reaching agreement among some 18 countries is never an easy task, so it's questionable if we'll see any tangible results from the September meeting.

Will the real Germany please stand up? Recent German numbers have been mixed. GDP and Business Climate looked weak, while recent manufacturing data has been sharp. This week started off on a high note, as the trade surplus climbed to EUR 22.2 billion, up from 16.2 billion a month earlier. This easily beat the estimate of 17.3 billion. The strong figure follows impressive German manufacturing data last week, led by Industrial Production, which gained 1.9% in August, its strongest showing in 2014. Inflation (or the lack of) continues to be a major concern in the Eurozone and German inflation levels have also been weak. Low inflation levels continue to weigh on the shaky euro, which finds itself looking upwards at the 1.30 line.

After months of fighting in eastern Ukraine between government forces and pro-Russian fighters, a week-hold appears to be holding up, although some sporadic fighting has been reported. Russia has denied assisting the rebels, but both Ukraine and NATO have said that Russian forces are in Ukraine and have taken part in the fighting. The crisis has severely strained relations between the West and Russia, and trade between Europe and Russia has suffered as a result. On Thursday, European countries and the US slapped further sections on Russia, which they said would be cancelled if the ceasefire continues to hold.

EUR/USD 1.2922 H: 1.2933 L: 1.2914

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.