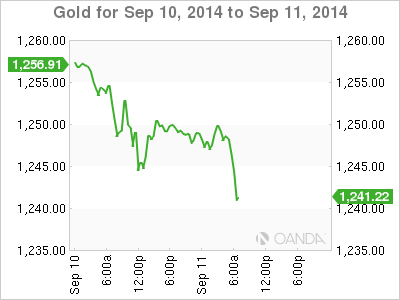

Gold has lost ground on Wednesday, as this week's downward spin continues. In the European session, the spot price stands at $1240.85 per ounce, its lowest level since early June. Today's highlight is Unemployment Claims. The estimate stands at 306 thousand, slightly higher than last week's reading of 302 thousand.

US numbers continue to point to a deepening recovery, but the labor market is showing some troubling signs. JOLTS Job Openings was unchanged in August at 4.67 million, short of the estimate of 4.72 million. On Friday, the eagerly-anticipated Nonfarm Employment Change crashed to 142 thousand, its lowest gain since January. This surprised the markets, which had expected a gain of 226 thousand. Unemployment Claims fell short of the estimate last week and another weak reading on Thursday could temper the dollar's impressive rally.

After months of fighting in eastern Ukraine between government forces and pro-Russian fighters, a ceasefire which began on Friday appears to be holding up, although some sporadic fighting has been reported. Russia has denied assisting the rebels, but both Ukraine and NATO have said that Russian forces have aided the separatists and attacked government positions. The crisis has severely strained relations between the West and Russia, and trade between Europe and Russia has suffered as a result. European countries have already implemented sanctions against Russia and have threatened further sanctions if the latest ceasefire does not hold.

XAU/USD 1240.85 H: 1250.16 L: 1238.23

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD favours extra retracements in the short term

AUD/USD kept the negative stance well in place and briefly broke below the key 0.6400 support to clinch a new low for the year on the back of the strong dollar and mixed results from the Chinese docket.

EUR/USD now shifts its attention to 1.0500

The ongoing upward momentum of the Greenback prompted EUR/USD to lose more ground, hitting new lows for 2024 around 1.0600, driven by the significant divergence in monetary policy between the Fed and the ECB.

Gold ascends but remains shy of testing $2,400 amid hawkish Fed remarks

Gold prices edged higher late in North American session, gaining 0.22% following a hawkish tilt by Fed Chair Jerome Powell. Economic data from the United States was mixed, though Monday’s Retail Sales report and Powell’s remarks kept US Treasury yields higher, capping the yellow metal’s advance.

Bitcoin price outlook amid increased demand and speculation pre-halving

Bitcoin price is edging lower as markets count only days to the halving. Nevertheless, the dump has not shaken the faith of large holders as they continue to cling to their holding even after a month of steady dumps.

UK CPI inflation data ahead: Sterling hovering north of key support

Following today's mixed bag of employment and wages data, today’s attention is directed to the March UK CPI inflation release. Both headline and core measures have surprised to the downside in the previous two releases and are expected to demonstrate further evidence of disinflation.