Gold is stable on Wednesday, as the pair trades at $1284.27 per ounce in the European session. It's a quiet day on the release front, with no major releases out of the US. On Tuesday, the Russian and Ukrainian presidents met as the crisis in eastern Ukraine continues.

There are hopes for some progress in the Ukraine crisis, as Russian president Vladimir Putin met with his Ukrainian counterpart Petro Poroshenko in Minsk on Tuesday. The meeting was discussed as "positive", but fighting between Ukrainian forces and pro-Russian militants continues. The crisis has plunged relations between Russia and the West to their lowest levels since the Cold War. Europe and the US have imposed sanctions and Moscow has been quick to retaliate. The impasse could hurt countries such as Germany, which have strong trade ties with Russia.

US durables painted a mixed picture on Tuesday. Core Durable Goods Orders, a key indicator, came in at -0.8%, its worst showing in 2014. This was nowhere near the estimate of +0.5%. At the same time, Durable Goods Orders stunned the markets with a record gain of 22.6%. The reason? A huge increase in the purchase of passenger planes in July. Meanwhile, the CB Consumer Sentiment looked sharp, pointing to strong optimism on the part of the US consumer. The indicator jumped to 92.4 points, up from 90.3 a month earlier.

There was some speculation that the financial meeting in Jackson Hole might be a market-mover, so the markets were all ears as Fed chair Janet Yellen delivered the keynote address on Friday. Any hopes for some dramatic news were dashed, however, as Yellen did not provide any clues as to the timing of a rate hike. She reiterated that the US job market still needed to improve, so employment numbers remain a crucial factor in any rate move by the Fed. There is a clear divergence in monetary stance between the ECB and the Fed, as the Fed is winding up QE, while the ECB may be forced to provide stimulus to the sagging Eurozone economy.

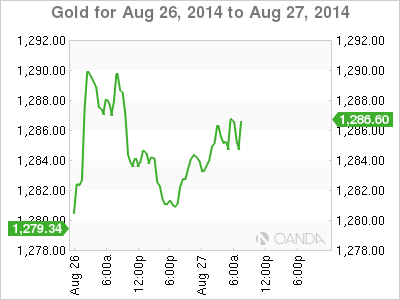

XAU/USD 1286.84 H: 1290.83 L: 1275.82

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.