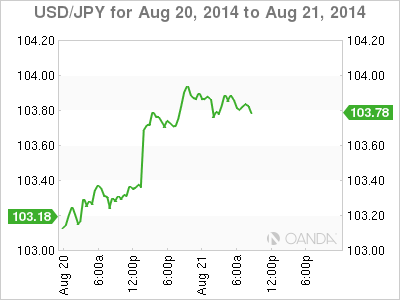

The US dollar continues to gain ground against the Japanese yen, as USD/JPY flirts with the 104 range early in the North American session. On the release front, Japanese Manufacturing PMI improved to 52.4 points, beating the estimate. US Unemployment Claims beat the estimate, coming in at 298 thousand. Later in the day, we'll get a look at the Philly Fed Manufacturing Index. The markets are braced for a sharp drop in the July reading.

In a highly anticipated event, the Federal Reserve released its policy meeting minutes on Wednesday. The minutes were hawkish in tone, with the Fed saying that an interest rate hike could come sooner rather than later if employment numbers continue to improve. The Fed said that the economy continues to improve, but the QE program, which is scheduled to wind up in October, will not be accelerated. The US dollar was broadly higher after the release of the minutes and gained about 80 points on Wednesday at the yen's expense.

The US economy has been moving in the right direction, but inflation numbers in the US remain at very low levels. On Tuesday, CPI and Core CPI, the primary gauges of consumer inflation, both posted paltry gains of 0.1%. These weak readings come on the heels of PPI, a manufacturing inflation index, which also came in at 0.1% last month. Weak inflation is one reason why the Federal Reserve is in no rush to raise interest rates, as low inflation points to slack in the economy. Meanwhile, US housing numbers were sharp on Tuesday. Building Permits improved to 1.05 million, beating the estimate of 1.00 million. Housing Starts jumped to 1.09 million, easily beating the estimate of 0.97 million.

Financial leaders and central bankers from around the world will gather in Jackson Hole, Wyoming for a conference which starts on Thursday. This will be Janet Yellen's first appearance as Fed chair at the conference. There is speculation that Jackson Hole could be a currency event, which would be a marked departure from the conference's usual focus on the US labor market and monetary policy. If this is the case, we could see a sharp reaction from the currency markets. Traders should treat Yellen's speech as a market-moving event.

USD/JPY 103.71 H: 103.96 L: 102.73

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.