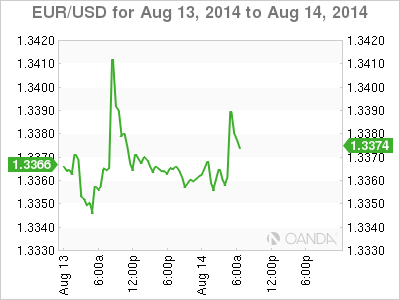

EUR/USD has posted modest gains on Thursday, as the pair continues to trade in the high-1.33 range. On the release front, it's a busy day in the Eurozone. GDP data from Germany, France and the Eurozone missed the estimates, while Eurozone inflation indicators matched the forecast. In the US, today's key event is Unemployment Claims. The markets are expecting the indicator to rise back above the 300 thousand level, with an estimate of 307 thousand.

Despite broad interest rate cuts by the ECB in June, growth and inflation levels have not risen. Economic growth remains in the doldrums. French Preliminary GDP remained flat at 0.0%, unchanged from a month earlier. German Preliminary GDP slipped to -0.2%, the first contraction in the German economy since Q4 of 2012. Eurozone Flash GDP also weakened to -0.2%, down from 0.0% in the previous release. All three GDP releases missed their estimates, and the weak numbers could push the euro even lower.

Eurozone inflation levels remain low, as the danger of deflation continues. Eurozone Final CPI dipped to 0.4%, down from 0.5% a month earlier. Eurozone Final Core CPI, a minor event, remained unchanged at 0.8%. Both indicators matched the forecast. On Wednesday, German inflation numbers remained weak, while French CPI posted its first decline since January.

With the Eurozone economy sputtering, it shouldn't come as a surprise that confidence indicators are pointing sharply downwards. German ZEW Economic Sentiment, a key release, took a tumble in July, falling to just 8.6 points, down from 27.1 points a month earlier, and its lowest level since November 2012. Weakening confidence in the economy could lead to decreased spending and hiring and weigh on economic growth.

In the US, retail sales data disappointed on Wednesday. Retail Sales dropped to a flat 0.0% last month, its weakest showing since January. The estimate stood at 0.2%. Core Retail Sales wasn't much better, posting a gain of 0.1%, down from 0.4% a month earlier. This was well short of the estimate of 0.4%. Retail sales are the primary gauge of consumer spending, and July's weak numbers points to a slow start to the third quarter. Although unemployment levels have dropped, this has not translated into stronger spending by the US consumer. We'll get a look at Unemployment Claims later in the day. The markets are expecting a weaker reading than the week before, with the estimate at 307 thousand.

EUR/USD 1.3384 H: 1.3396 L: 1.3349

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.