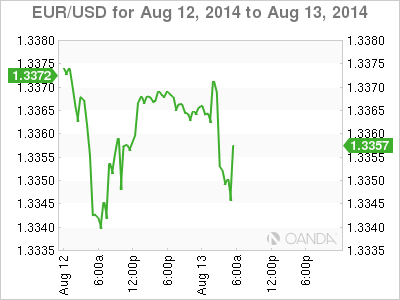

EUR/USD continues to post downwards, as the pair has posted slight losses on Wednesday. In the European session, the pair is trading in the mid-1.33 range. On the release front, German and French inflation numbers remained low. As well, Eurozone Industrial Production posted a second straight decline. In the US, today's major events are Core Retail Sales and Retail Sales. The markets are keeping a close eye on Eurozone GDP and inflation data, which will be released on Thursday.

Despite broad interest rate cuts by the ECB in June, Eurozone growth and inflation levels have not improved. On Wednesday, German inflation numbers remained weak, while French CPI posted its first decline since January. There was no relief from Eurozone Industrial Production, which came in at -0.3%, its third decline in four readings. This disappointed the markets, which had expected an estimate of 0.5%. The euro remains under strong pressure, and if Eurozone GDP and CPI readings miss expectations, we could see the currency slide further.

With the Eurozone economy sputtering, it shouldn't come as a surprise that confidence indicators are pointing sharply downwards. German ZEW Economic Sentiment, a key release, took a tumble in July, falling to just 8.6 points, down from 27.1 points a month earlier, and its lowest level since November 2012. The estimate stood at 18.2 points. This is the latest figure in a string of weak German releases. Last week, the trade surplus narrowed and manufacturing numbers missed expectations. With economic indicators pointing downward and confidence in the German economy ebbing, we could see a decline in German GDP in the second quarter, which would likely have a chilling effect on the shaky euro. Eurozone ZEW Economic Sentiment followed suit, slipping to 23.7 points, compared to 48.1 points in the previous release. The markets had expected a reading of 41.3 points.

In the US, employment indicators are under the market microscope, as the strength of the labor market is one of the most important factors influencing the Federal Reserve regarding the timing of an interest rate hike. A rate hike is expected by mid-2015, but stronger economic data, especially on the employment front, could hasten a rate move. There was positive news on Tuesday, as JOLTS Job Openings continued to improve and climbed to a 13-year low. We'll get a look at Unemployment Claims on Thursday.

EUR/USD 1.3354 H: 1.3374 L: 1.3342

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.