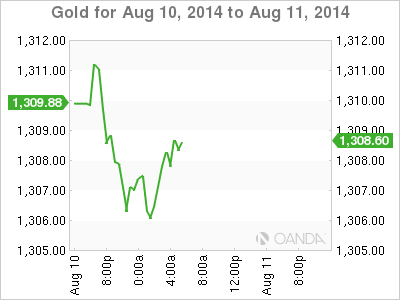

Gold prices are steady as we start the new trading week. In Monday's European session, the spot price stands at $1309.82 an ounce. On the release front, there is only one release on the schedule, as Federal Reserve Governor Stanley Fischer speaks at a conference in Stockholm.

Gold crossed above the $1300 level last week, climbing as high as $1322 on Friday. The precious metal has benefited as the crises in Ukraine and Iraq have worsened. The US has accused Russia of massing troops on its border with Ukraine, and tensions are high as the EU has slapped stronger sanctions on Russia, while Moscow has retaliated by banning many food imports from the West. In Iraq, Islamic State militants, who have captured large parts of Iraq, have attacked and displace thousands of ethnic Kurds, which has resulted in a growing humanitarian crisis. On Thursday, US President Barak Obama authorized air strikes against the militants in order to protect the Kurds and safeguard US interests. The situation in Iraq is volatile and could quickly destabilize even further.

As expected, the ECB maintained interest rates at 0.15% at its policy meeting last week. ECB head Mario Draghi didn't add anything dramatic in his press conference, acknowledging that the Eurozone continues to grapple with weak growth and inflation levels. Draghi said that the ECB forecasts "moderate" improvement in growth and that interest rates will remain at current levels for the near future. On the inflation front, Draghi does not expect any improvement before 2015. With interest rates already at record lows, the ECB may be forced to resort to unconventional monetary tools if the situation worsens.

US releases enjoyed a solid week, led by the IMS Non-Manufacturing PMI and Unemployment Claims. The PMI, which measures the strength of the services sector, climbed to 58.6 points, a ten-month high. Unemployment Claims dropped to 289 thousand, beating the estimate of 305 thousand. The four-week claims average, which is less volatile than the weekly count, dipped to 293,500, its lowest level since February 2006. The improving labor market points to a growing economy, and the dollar has gained broad strength thanks to solid economic data.

XAU/USD 1308.64 H: 1309.21 L: 1305.21

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to modest gains above 1.0650 ahead of US data

EUR/USD trades modestly higher on the day above 1.0650 in the early American session on Tuesday. The upbeat PMI reports from the Eurozone and Germany support the Euro as market focus shift to US PMI data.

GBP/USD extends rebound, tests 1.2400

GBP/USD preserves its recovery momentum and trades near 1.2400 in the second half of the day on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.