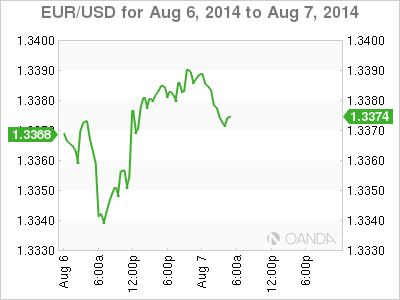

EUR/USD is steady on Thursday, as the pair continues to trade close to nine-month lows. In the European session, the pair is trading in the mid-1.33 range. Today's highlight is the ECB rate statement, with the ECB expected to maintain rates at their current level of 0.15%. Elsewhere, German Industrial Production posted a small gain of 0.3%, well below expectations. In the US, the day's major event is Unemployment Claims. Little change is expected in this release.

The ECB will be in the spotlight later on Thursday, but the markets are not expecting any dramatic announcements. In June, the ECB cut rates to a record low of 0.15% in order to boost growth and stave off deflation. However, inflation levels have not risen, and continuing tension with Russia over Ukraine has had a negative impact on growth. German numbers have softened and Italy is officially in recession, having posted a decline in GDP for two consecutive quarters. This leaves ECB President Mario Draghi in a difficult position, with few tools in his arsenal to boost the struggling Eurozone economy.

German numbers continue to point to trouble in the Eurozone's largest economy. Industrial Production posted a gain of 0.3%, but this was nowhere close to the forecast of 1.4%. On Tuesday, Factory Production declined by 3.2%, the steepest drop since October 2012. The Bundesbank is blaming tensions with Russia and stronger EU sanctions against Moscow for the weak economic numbers, as Germany is Russia's number one trading partner in Europe. With key indicators pointing downward and confidence in the German economy ebbing, we could see a decline in GDP in the second quarter, which could have a chilling effect on the shaky euro.

US PMIs posted strong gains in July. On Tuesday, ISM Non-manufacturing PMI looked sharp, rising to 58.7 points last month. This easily beat the estimate of 56.6, and was the index’s best showing since February 2011. This follows an excellent Manufacturing PMI reading last week, with the index climbing to 57.1 points, a three-year high. There was more positive news on Tuesday, as Factory Orders had an impressive July, gaining 1.1%. These solid numbers point to healthy expansion in the US manufacturing and services sectors, which has helped the dollar gain ground at the euro's expense.

EUR/USD 1.3377 H: 1.3392 L: 1.3365

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.