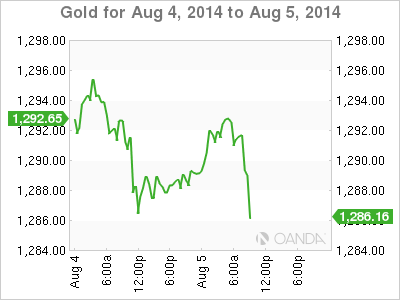

Gold prices are showing little movement on Tuesday. Late in the European session, the spot price stands at $1289.07 an ounce. On the release front, there is just one event in the US, ISM Non-manufacturing PMI. The markets are expecting a slight improvement in the July reading, with an estimate of 56.6 points.

US employment numbers were a disappointment last week, although there was good news in other sectors, and these solid releases have boosted the US dollar and kept gold prices under $1300. On Friday, Nonfarm Payrolls took a tumble, slipping to 209 thousand, compared to 288 thousand a month earlier. This was well below the estimate of 231 thousand and marked a four-month low. Earlier in the week, Unemployment Claims rose to 302 thousand, very close to the estimate of 303 thousand. There was positive news from the manufacturing sector, as US ISM Manufacturing PMI rose to 57.1 points, its best showing since November. As well, UoM Consumer Sentiment continues to look strong, coming in at 81.8 points. The index has not been below the 80-point level in 2014, pointing to strong consumer confidence.

There were no surprises from last week's Federal Reserve policy statement, which was somewhat dovish in tone. Policymakers acknowledged lower US unemployment levels, but noted that "there remains significant underutilization of labor resources" in the economy. The Fed statement reinforces the view that the US central bank is in no rush to raise interest rates after the termination of QE, which is expected in October. As well, the Fed said that inflation levels have moved somewhat closer to the Fed's target of 2.0%. The Fed has remained vague as to when it will raise interest rates, but if the economy continues moving in the right direction, a rate increase is likely before mid-2105.

XAU/USD 1289.07 H: 1293.54 L: 1287.29

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD holds above 1.2350 after UK PMIs

GBP/USD clings to modest daily gains above 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.