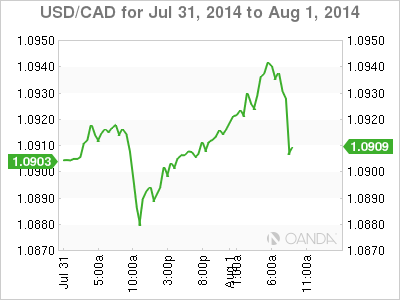

The Canadian dollar continues to travel south, as USD/CAD trades in the low-1.09 range on Friday. In the US, the markets will have plenty of data to sort through, with three key events later in the day - Nonfarm Employment Change, Unemployment Rate and ISM Manufacturing PMI. We'll also get a look at consumer confidence levels, with the release of UoM Consumer Sentiment. There are no Canadian releases on Friday.

Unemployment Claims came in at 302 thousand on Thursday, higher than the previous release but very close to the estimate of 303 thousand. Earlier in the week, ADP Nonfarm Payrolls posted a sharp drop. If the official NFP release follows suit and misses the estimate of 234 thousand, the US dollar could give up some if its recent gains. Meanwhile, US GDP exceeded expectations in the second quarter, as the economy expanded at an annual rate of 4.0%. This easily beat the estimate of 3.1% and marked the strongest quarter of economic growth since Q4 in 2009. The boost in economic activity was helped by strong consumer confidence and business investment, as well as solid employment data.

The Federal Reserve released a policy statement on Wednesday, with the Fed sounding somewhat dovish in tone. Policymakers acknowledged lower unemployment levels, but noted that "there remains significant underutilization of labor resources" in the economy. The Fed statement reinforces the view that the US central bank is in no rush to raise interest rates after the termination of QE, which is expected in October. As well, the Fed said that inflation levels have moved somewhat closer to the Fed's target of 2.0%.

The Canadian dollar has had a rough week, losing about 140 points and trading at its lowest levels since early June. The loonie showed signs of life on Thursday, courtesy of unexpected positive news from Canadian GDP. The key indicator rose 0.4% in June, edging above the estimate of 0.3%. However, it didn't take long for the US dollar to recover, as USD/CAD is back above the 1.09 line.

USD/CAD 1.0929 H: 1.0944 L: 1.0906

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.