The euro is flat on Friday, as EUR/USD continues to trade shy of the 1.34 level in the European session. In economic news, Spanish and Italian Manufacturing PMIs softened in June, disappointing the markets. It's a busy day in the US, with three key events later in the day - Nonfarm Employment Change, Unemployment Rate and ISM Manufacturing PMI. We'll also get a look at consumer confidence levels, with the release of UoM Consumer Sentiment.

It's been a quiet week for the euro, but that could change on Friday, as the US releases key employment data. On Thursday, Unemployment Claims came in at 302 thousand, higher than the week before but very close to the estimate of 303 thousand. Earlier in the week, ADP Nonfarm Payrolls posted a sharp drop. If the official NFP release follows suit and misses expectations, the euro could make up some ground against the dollar.

Eurozone Manufacturing PMIs are closely tracked by analysts, as they are important gauges of the health of the manufacturing sectors in the Eurozone economies. The Spanish PMI came in at 53.9 points and the Italian figure at 51.9. Although these fell short of the estimates, they both remained above the 50-point level, which marks expansion. Eurozone Manufacturing PMI was unchanged at 51.8, almost matching the estimate of 51.9.

On Thursday, Eurozone CPI, one of most important indicators, edged lower to 0.4%. Although this was close to the estimate of 0.5%, this figure was the lowest in almost five years, and raises concerns of deflation. There was better news from the Eurozone Unemployment Rate, which dipped to 11.4%, its lowest level since September 2012. German data was positive, led by Retail Sales which jumped 1.3%, beating the estimate of 1.1%. German Unemployment Change posted a decline of 12,000, easily surpassing the estimate of a drop of 5,000.

US GDP exceeded expectations in the second quarter, expanding at an annual rate of 4.0%. This easily beat the estimate of 3.1% and marked the strongest quarter of economic growth since Q4 of 2009. The boost in economic activity was helped by strong consumer confidence and business investment, as well as solid employment data. The US dollar took advantage of the strong numbers, posting gains against its major rivals.

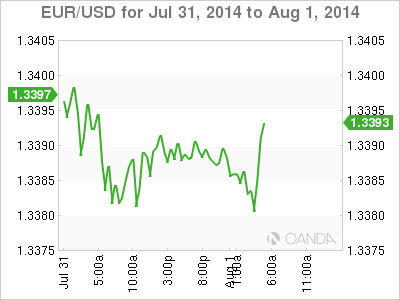

EUR/USD August 1 at 7:50 GMT

EUR/USD 1.3381 H: 1.3392 L: 1.3380

EUR/USD Technical

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

How will US Dollar react to Q1 GDP data? – LIVE

The US' GDP is forecast to grow at an annual rate of 2.5% in the first quarter of the year. The US Dollar struggles to find demand as investors stay on the sidelines, while waiting to assess the impact of the US economic performance on the Fed rate outlook.

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.