The Canadian dollar finds itself above the 1.08 line, following losses late last week against its US counterpart. In the US, Flash Services PMI was almost unchanged in June. Pending Home Sales shocked with a decline of 1.1%, its worst showing in 2014. There are no Canadian releases on Monday.

The US ended last week on a high note, courtesy of strong data from the manufacturing sector. Core Durable Goods Orders jumped 0.8%, beating the estimate of 0.6%, and rebounding nicely from a decline of 0.1% in May. Durable Goods Orders followed suit, posting a gain of 0.7%, compared to a weak reading of -1.0% last month. This easily surpassed the estimate of 0.4%. Unemployment Claims tumbled last week, as the key indicator fell to 284 thousand, its lowest level since February 2008. This surprised the markets, which had expected a reading of 310 thousand. The strong release continues a string of solid employment data, which has helped the dollar. As well, positive news on the employment front is bound to increase speculation about a rate increase by the Federal Reserve.

Canadian retail sales figures in June were a major disappointment. Core Retail Sales posted a paltry gain of 0.1%, compared to 0.7% in the previous release. This missed the estimate of 0.3%. Retail Sales came in at 0.7%, compared to 1.1% in the May reading. This was enough to beat the estimate, which stood at 0.6%. Canada will release inflation data on Wednesday, with the markets expecting stronger readings for the June releases.

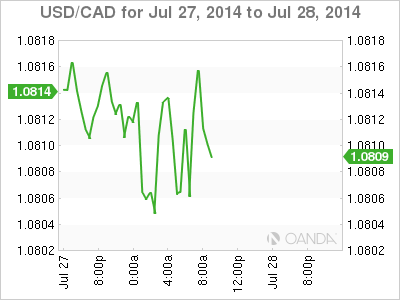

USD/CAD 1.0812 H: 1.0818 L: 1.0801

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price trades with mild negative bias, manages to hold above $2,300 ahead of US data

Gold price (XAU/USD) edges lower during the early European session on Wednesday, albeit manages to hold its neck above the $2,300 mark and over a two-week low touched the previous day.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.