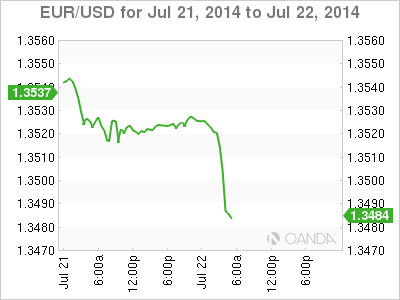

EUR/USD has lost ground on Tuesday, as the pair trades below the low-1.35 line in the European session. Continuing violence in Gaza and Ukraine has lent support to the safe-haven US dollar. On the release front, it's a busy day in the US, highlighted by Core CPI and Existing Home Sales. There are no Eurozone events on the schedule.

International trouble spots continue to grab the headlines, as nervous investors keep an eye on events Ukraine and the Middle East. Last week's downing of a Malaysian Airlines jet, apparently by pro-Russian separatists, has seriously frayed relations between Europe and the US with Russia, which have already been strained since the latter annexed Crimea. Fighting continues between the separatists and Ukrainian forces in Eastern Ukraine. The Europeans are threatening stronger sanctions against Russia, and escalating tensions within Europe does not bode well for the euro. Meanwhile, the fighting in Gaza between Hamas and Israel has intensified, as the international community scrambles to try to get the two sides to agree to a cease fire. Casualties have been mounting on both sides following Israel's ground offensive into Gaza.

On Friday, US Consumer Sentiment remained steady at 81.3 points, but this was well below the estimate of 83.5 points. A day earlier, Unemployment Claims dropped slightly to 302 thousand, beating the estimate of 310 thousand. This figure marks a seven-week low, as the economy continues to churn out impressive employment data. With Janet Yellen telling Congress that a rate hike could be pushed forward if inflation and employment data exceeds expectations, improving employment data will put more pressure on the Fed to raise rates.

Try as it might, the ECB can't seem to coax much inflation out of the Eurozone economy. Eurozone CPI, the primary gauge of consumer inflation, remained unchanged in June, posting a gain of 0.5%. This is well below the central bank's target of 2%. Germany, the Eurozone's largest economy, is also suffering from weak inflation. PPI came in at a flat 0.0%, and the manufacturing inflation index has failed to post a gain in 2014. Faced with weak inflation and growth levels in the Eurozone, the ECB will be under pressure to take some action at its August policy meeting.

EUR/USD 1.3489 H: 1.3530 L: 1.3481

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.