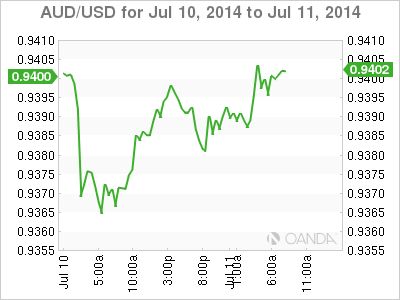

AUD/USD has edged higher in Friday trade, as the pair trades at the 0.94 in the European session. On the release front, there are no key events on the schedule. In Australia, Home Loans beat the estimate. In the US, Friday's lone release is the Federal Budget Balance, a minor event.

Australian Home Loans is an important gauge of activity in the housing sector. The indicator posted a flat reading of 0.0% for the second straight month. This surprised the markets, which had expected a reading of -0.6%. On Thursday, Australian employment data was a mix. Employment Change rebounded in May with a strong gain of 15.9 thousand, easily beating the estimate of 12.3 thousand. At the same time, Unemployment Rate rose to 6.0%, the highest level seen since February. This edged above the estimate of 5.9%. Earlier in the week, there were solid consumer and business confidence levels, which are important catalysts for economic growth. NAB Business Confidence hit its highest level since January, while Westpac Consumer Confidence gained 1.9%, an eight-month high.

In the US, Unemployment Claims dropped, as the economy continues to churn out solid employment numbers. The key indicator dropped to 304 thousand, well below the estimate of 316 thousand. Employment numbers for June have looked sharp, led by a jump in Nonfarm Payrolls and a drop in the unemployment rate. The strong employment numbers have increased speculation about an interest rate hike by the Federal Reserve, and remarks by Fed policymakers will be under the market microscope.

The Federal Reserve minutes did not shed much light on when the Fed plans to raise interest rates, but policymakers did agree to wind up the QE scheme by October. The asset purchase program flooded the economy with over $2 trillion, and the Fed has been steadily reducing the program since last December. Winding down QE will require several more tapers by the Fed, but that shouldn't pose a problem, given the solid employment data the economy has been churning out.

AUD/USD 0.9400 H: 0.9406 L: 0.9378

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.