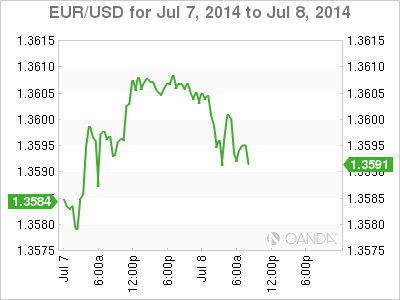

EUR/USD is showing little movement on Tuesday, as the pair trades just below the 1.36 line. There are no major releases on today's schedule. In the Eurozone, German Trade Balance posted a wider surplus, as the indicator hit an eight-month low. In the US, today's highlight is JOLTS Job Openings. The markets are expecting a strong reading in the June release.

There was finally some positive news out of Germany, after a rash of weak data from the Eurozone's largest economy. Trade Balance improved last month, posting a surplus of EUR 18 billion, the highest reading since last October. This easily surpassed the estimate of EUR 15.7 billion. German retail sales, employment and manufacturing data softened in May, causing concern that a weakening German economy could dash hopes of growth in the Eurozone and hurt the euro.

US employment numbers impressed last week, led by Nonfarm Payrolls and the Unemployment Rate sparkled. Nonfarm Payrolls, one of the most important indicators, bounced back in June with a strong gain of 288 thousand new jobs. This crushed the estimate of 214 thousand. Unemployment Claims was steady at 315 thousand, almost replicating the estimate of 314 thousand. There was more good news from the Unemployment Rate, which continues to move downward. The indicator dipped to 6.1%, its lowest level since September 2008. The strong employment numbers are sure to increase speculation about an interest rate hike by the Federal Reserve, and remarks by Fed policymakers will be under the market microscope.

As widely expected, the ECB maintained the benchmark interest rate at 0.15% at its July policy meeting, held late last week. This was is sharp contrast to the previous meeting, in which the ECB lowered the benchmark rate from 0.25% and introduced negative deposit rates for the first time. At this week's meeting, ECB head Mario Draghi noted that inflation rates remain very low, and said that the ECB was ready to implement "unconventional instruments" if necessary. As well, Draghi reiterated that the ultra-low interest rates would remain at current levels or lower for the foreseeable future.

EUR/USD 1.3593 H: 1.3610 L: 1.3588

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.