EUR/USD is showing little movement on Thursday, as the pair trades in the mid-1.36 range in the European session. On the release front, Spanish Unemployment Change posted a sharp decline, but fell short of expectations. It's a busy day on the release front, and traders can expect some movement from EUR/USD during the day. In the Eurozone, Eurozone and Spanish Services PMI softened, while Italian Services PMI improved. Eurozone Retail Sales dropped to a flat 0.0%, its worst showing in five months. Later in the day, the ECB will announce its benchmark interest rate, followed by a press conference hosted by ECB head Mario Draghi. In the US, employment data is in the spotlight, with the releases of Nonfarm Payrolls, the Unemployment Rate and Unemployment Claims. As well, the US will release Trade Balance.

Will the ECB take any dramatic action at its policy meeting later on Thursday? Most analysts are saying no, with the ECB expected to hold rates at the record low of 0.15% and maintain current monetary policy. At the June meeting, the ECB took unprecedented steps to combat low growth and inflation, including negative deposit rates. These measures were intended to boost inflation and growth levels, but that hasn't occurred, at least not yet. This was reaffirmed with the release of Eurozone Retail Sales on Thursday, the primary gauge of consumer spending. The indicator dipped to 0.0%, shy of the estimate of 0.3%.

Weak German data continues to be a source of concern. The week started with Retail Sales, the primary gauge of consumer spending, posting its third straight decline. The indicator came in at -0.6% last month, well off the forecast of +0.8%. Unemployment Change, which had posted strong declines in the first quarter of the year, has reversed direction and recorded two straight gains, pointing to trouble in the employment sector. In June, the indicator came in at +9K, compared to an estimate of -9K. The euro is sensitive to German data, as Germany is the largest economy in the Eurozone.

In the US, ADP Nonfarm Payrolls was outstanding, soaring to 281 thousand, up from 179 thousand a month earlier. This crushed the estimate of 207 thousand. Will the official Nonfarm Payrolls follow suit? The markets are expecting a reading of 214 thousand, slightly below the May reading. The Unemployment Rate and Unemployment Claims are also expected to show little change. If there are any surprises from these key indicators, traders can expect some movement from EUR/USD during the day.

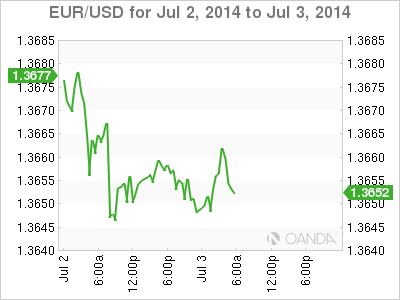

EUR/USD 1.3654 H: 1.3664 L: 1.3645

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.