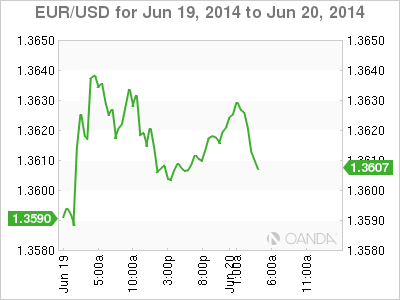

EUR/USD is firm on Friday, as the pair is back above the 1.36 line, after some gains earlier in the week. On the release front, German PPI posted its third consecutive decline, as Eurozone inflation indicators continue to falter. There was better news from Eurozone Current Account, which improved in May. Although US markets are open on Friday, there are no releases on the schedule, so traders should be prepared for a quiet day from the pair.

Eurozone inflation rates continued to look dismal in May, as German PPI posted another decline, coming in at -0.2%. The manufacturing inflation index has failed to post a gain in 2014, pointing to weakness in the German manufacturing sector. The ECB lowering rates earlier in the month, declaring that the moves were intended to bolster weak growth and inflation levels in the region. However, we'll have to wait for the June inflation data to see if the ECB's moves push inflation to higher levels. If not, the euro could lose ground against the dollar. Earlier in the week, German ZEW Economic Sentiment lost ground, although somewhat surprisingly, the same Eurozone indicator showed improvement. We'll get a look at Eurozone Consumer Confidence later on Friday. The markets are expecting another weak reading in May.

On Wednesday, the Federal Reserve continued to taper to its QE program, reducing the scheme by $10 billion, to $35 billion/month. If all goes as planned, the Fed could wind up QE in the fall. The Fed also hinted that interest rates will continue to stay low for the foreseeable future, which likely means that we won't see any rate hikes before the first quarter of 2015. With regard to economic activity, the Fed noted that the recovery is continuing, but it reduced its forecast of economic growth to 2.1-2.3%, down from an earlier forecast of around 2.9 percent. The bottom line? There were no dramatic items in the Fed statement, with one analyst describing current Fed policy as "steady as she goes". The US dollar has responded with losses against its major rivals, and the euro has added about 70 points this week and pushed across the 1.36 line.

EUR/USD 1.3609 H: 1.3634 L: 1.3605

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.